Summary

Recently, there are many trials to apply reinforcement learning in asset allocation for earning more stable profits. In this paper, we compare performance between several reinforcement learning algorithms - actor-only, actor-critic and PPO models. Furthermore, we analyze each models' character and then introduce the advanced algorithm, so called Reward clipping model. It seems that the Reward Clipping model is better than other existing models in finance domain, especially portfolio optimization - it has strength both in bull and bear markets. Finally, we compare the performance for these models with traditional investment strategies during decreasing and increasing markets.

AI Key Findings

Generated Sep 07, 2025

Methodology

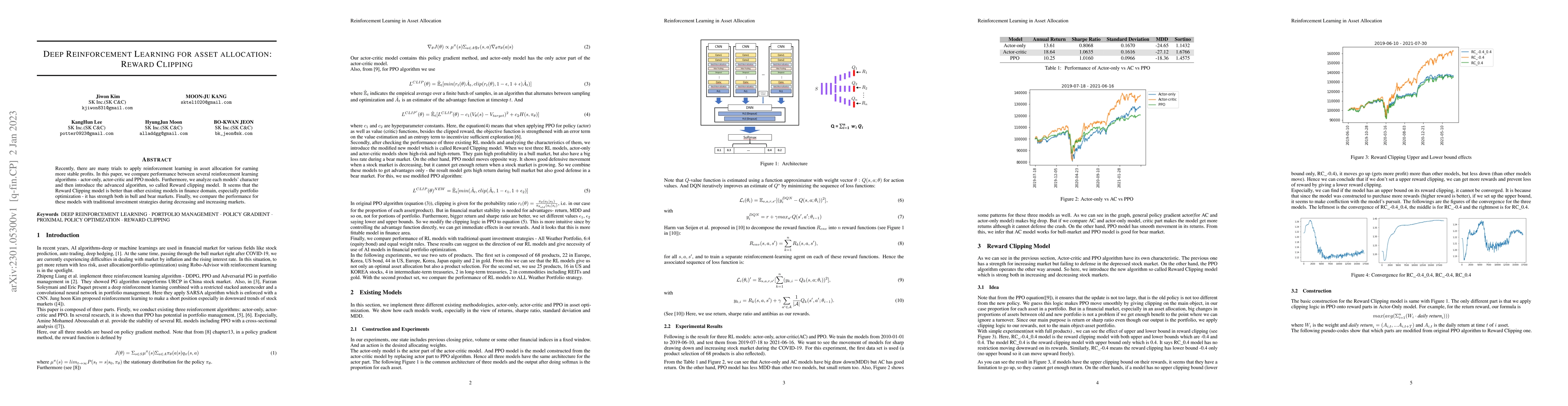

The research applies deep reinforcement learning algorithms (actor-only, actor-critic, and PPO) to asset allocation, comparing their performance and introducing a new Reward Clipping model.

Key Results

- The Reward Clipping model outperforms existing models in finance, especially in portfolio optimization, showing strength in both bull and bear markets.

- The Reward Clipping model with a lower bound performs effectively in a falling market, defending against declines better than the Actor-only model.

- The Reward Clipping model demonstrates less drawdown and more benefits in increasing situations, combining the strengths of Actor-critic and PPO algorithms.

- The Reward Clipping model requires fewer resources compared to the PPO model, making it resource-efficient.

Significance

This research is significant as it enhances asset allocation strategies using deep reinforcement learning, providing a model (Reward Clipping) that performs well in both bull and bear markets, which is crucial for stable profit generation.

Technical Contribution

The paper introduces the Reward Clipping model, which clips rewards instead of the main object (asset portfolio), enabling the model to perform well in both increasing and decreasing stock markets.

Novelty

The novelty of this work lies in the Reward Clipping model, which combines the strengths of existing models (Actor-only, Actor-critic, and PPO) by clipping rewards instead of the main object, providing a robust solution for asset allocation in varying market conditions.

Limitations

- The study focuses on ETFs and does not yet incorporate a wide range of financial products like stocks, funds, and commodities.

- The research applies the reward clipping algorithm to the actor-only model; future work should extend this to actor-critic models.

Future Work

- Expand the model to include various financial products such as stocks, funds, and commodities.

- Apply the reward clipping algorithm to actor-critic models to further enhance performance.

- Investigate the integration of risk management systems to detect and react to risks dynamically in real-world scenarios.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCombining Reinforcement Learning and Inverse Reinforcement Learning for Asset Allocation Recommendations

Xiao Zhang, Jiayu Liu, Igor Halperin

No citations found for this paper.

Comments (0)