Summary

Asset allocation (or portfolio management) is the task of determining how to optimally allocate funds of a finite budget into a range of financial instruments/assets such as stocks. This study investigated the performance of reinforcement learning (RL) when applied to portfolio management using model-free deep RL agents. We trained several RL agents on real-world stock prices to learn how to perform asset allocation. We compared the performance of these RL agents against some baseline agents. We also compared the RL agents among themselves to understand which classes of agents performed better. From our analysis, RL agents can perform the task of portfolio management since they significantly outperformed two of the baseline agents (random allocation and uniform allocation). Four RL agents (A2C, SAC, PPO, and TRPO) outperformed the best baseline, MPT, overall. This shows the abilities of RL agents to uncover more profitable trading strategies. Furthermore, there were no significant performance differences between value-based and policy-based RL agents. Actor-critic agents performed better than other types of agents. Also, on-policy agents performed better than off-policy agents because they are better at policy evaluation and sample efficiency is not a significant problem in portfolio management. This study shows that RL agents can substantially improve asset allocation since they outperform strong baselines. On-policy, actor-critic RL agents showed the most promise based on our analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

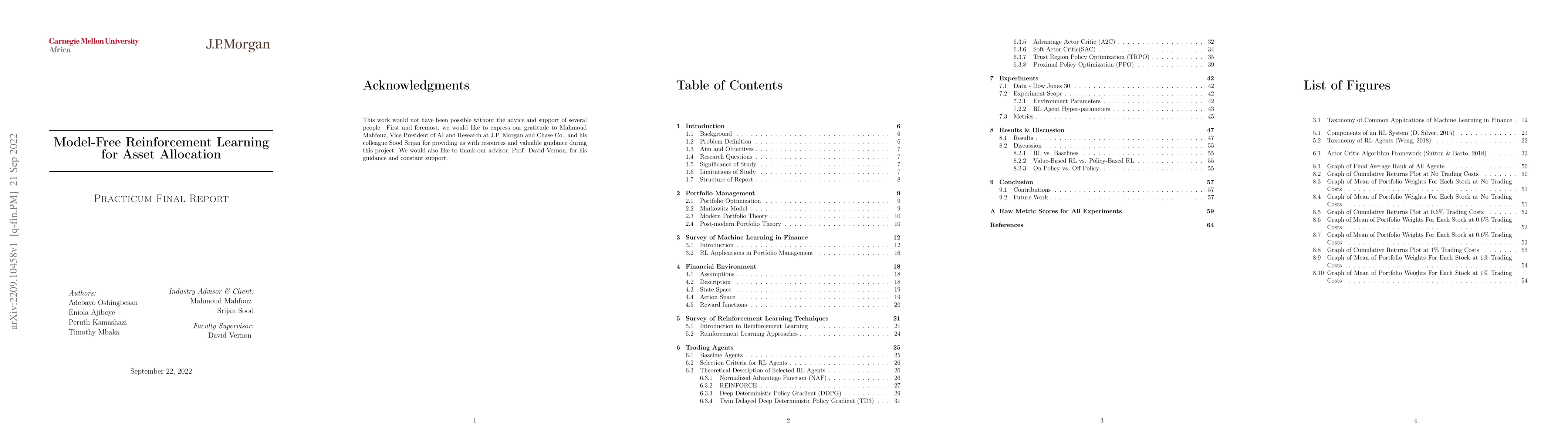

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning for Asset Allocation: Reward Clipping

Jiwon Kim, Moon-Ju Kang, KangHun Lee et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)