Summary

We study asset price bubbles in market models with proportional transaction costs $\lambda\in (0,1)$ and finite time horizon $T$ in the setting of [49]. By following [28], we define the fundamental value $F$ of a risky asset $S$ as the price of a super-replicating portfolio for a position terminating in one unit of the asset and zero cash. We then obtain a dual representation for the fundamental value by using the super-replication theorem of [50]. We say that an asset price has a bubble if its fundamental value differs from the ask-price $(1+\lambda)S$. We investigate the impact of transaction costs on asset price bubbles and show that our model intrinsically includes the birth of a bubble.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

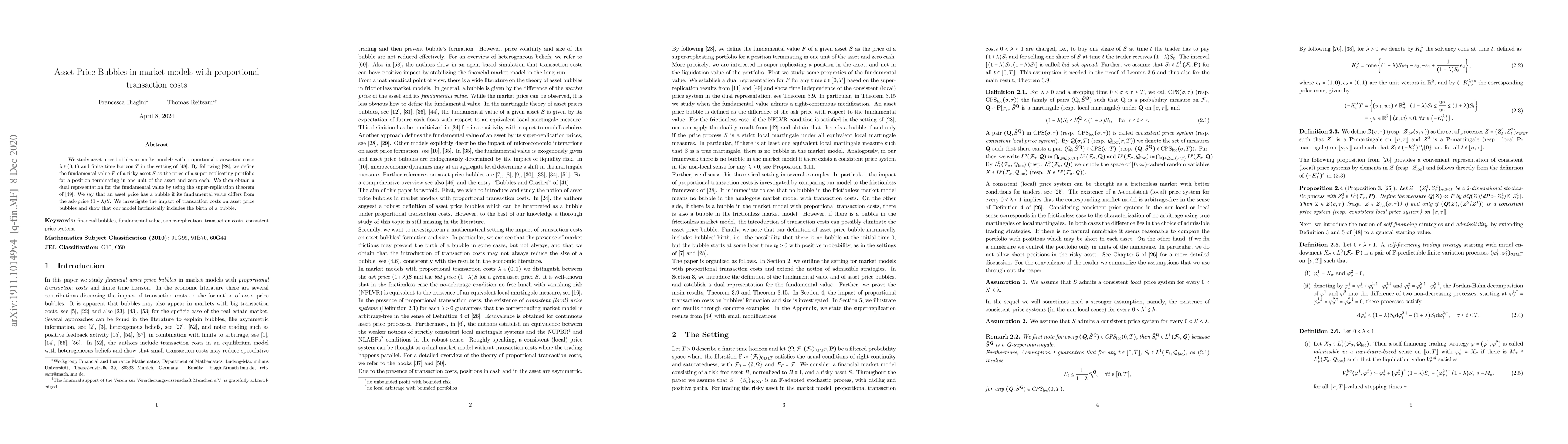

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)