Summary

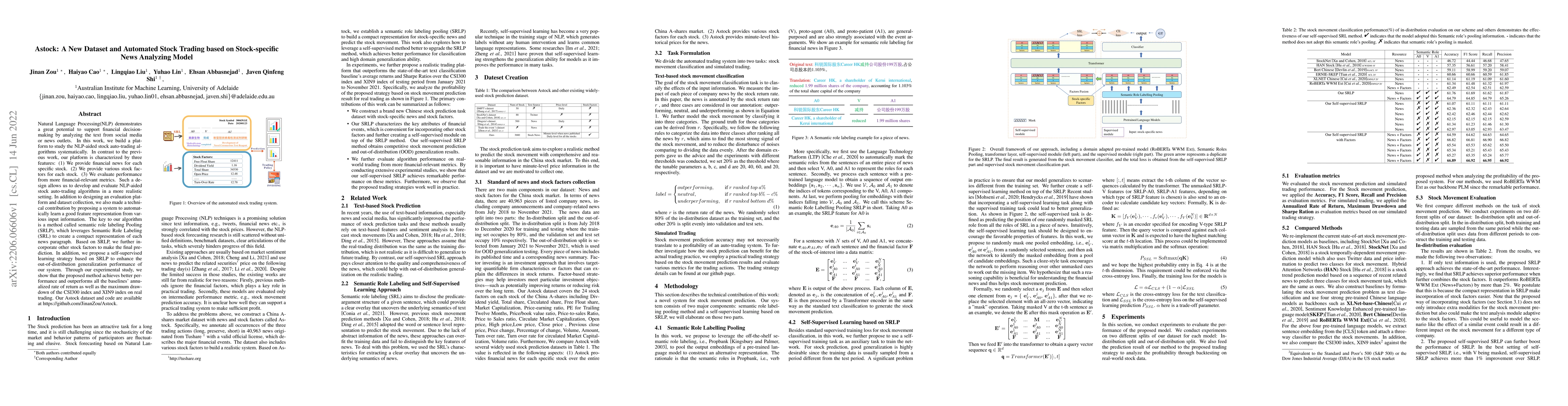

Natural Language Processing(NLP) demonstrates a great potential to support financial decision-making by analyzing the text from social media or news outlets. In this work, we build a platform to study the NLP-aided stock auto-trading algorithms systematically. In contrast to the previous work, our platform is characterized by three features: (1) We provide financial news for each specific stock. (2) We provide various stock factors for each stock. (3) We evaluate performance from more financial-relevant metrics. Such a design allows us to develop and evaluate NLP-aided stock auto-trading algorithms in a more realistic setting. In addition to designing an evaluation platform and dataset collection, we also made a technical contribution by proposing a system to automatically learn a good feature representation from various input information. The key to our algorithm is a method called semantic role labeling Pooling (SRLP), which leverages Semantic Role Labeling (SRL) to create a compact representation of each news paragraph. Based on SRLP, we further incorporate other stock factors to make the final prediction. In addition, we propose a self-supervised learning strategy based on SRLP to enhance the out-of-distribution generalization performance of our system. Through our experimental study, we show that the proposed method achieves better performance and outperforms all the baselines' annualized rate of return as well as the maximum drawdown of the CSI300 index and XIN9 index on real trading. Our Astock dataset and code are available at https://github.com/JinanZou/Astock.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Novel Deep Reinforcement Learning Based Automated Stock Trading System Using Cascaded LSTM Networks

Jie Zou, Jiashu Lou, Baohua Wang et al.

FinReport: Explainable Stock Earnings Forecasting via News Factor Analyzing Model

Xinjie Shen, Jin Xu, Yawen Zeng et al.

A Deep Reinforcement Learning Approach to Automated Stock Trading, using xLSTM Networks

Armin Salimi-Badr, Faezeh Sarlakifar, Mohammadreza Mohammadzadeh Asl et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)