Authors

Summary

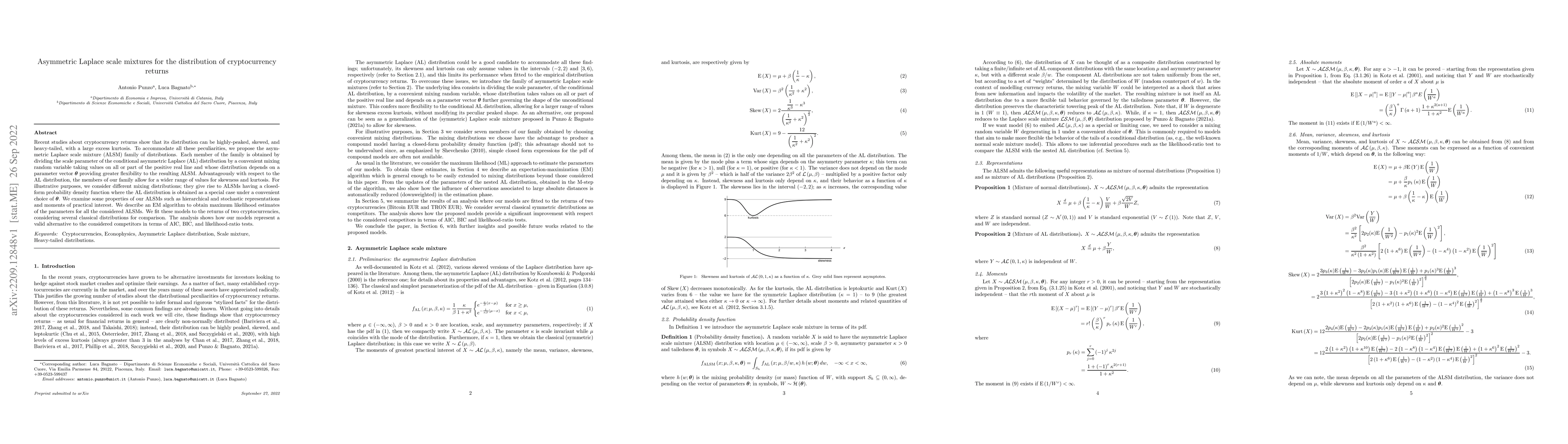

Recent studies about cryptocurrency returns show that its distribution can be highly-peaked, skewed, and heavy-tailed, with a large excess kurtosis. To accommodate all these peculiarities, we propose the asymmetric Laplace scale mixture (ALSM) family of distributions. Each member of the family is obtained by dividing the scale parameter of the conditional asymmetric Laplace (AL) distribution by a convenient mixing random variable taking values on all or part of the positive real line and whose distribution depends on a parameter vector $\boldsymbol{\theta}$ providing greater flexibility to the resulting ALSM. Advantageously with respect to the AL distribution, the members of our family allow for a wider range of values for skewness and kurtosis. For illustrative purposes, we consider different mixing distributions; they give rise to ALSMs having a closed-form probability density function where the AL distribution is obtained as a special case under a convenient choice of $\boldsymbol{\theta}$. We examine some properties of our ALSMs such as hierarchical and stochastic representations and moments of practical interest. We describe an EM algorithm to obtain maximum likelihood estimates of the parameters for all the considered ALSMs. We fit these models to the returns of two cryptocurrencies, considering several classical distributions for comparison. The analysis shows how our models represent a valid alternative to the considered competitors in terms of AIC, BIC, and likelihood-ratio tests.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTackling the infinite likelihood problem when fitting mixtures of shifted asymmetric Laplace distributions

Yuan Fang, Sanjeena Subedi, Brian C. Franczak

| Title | Authors | Year | Actions |

|---|

Comments (0)