Summary

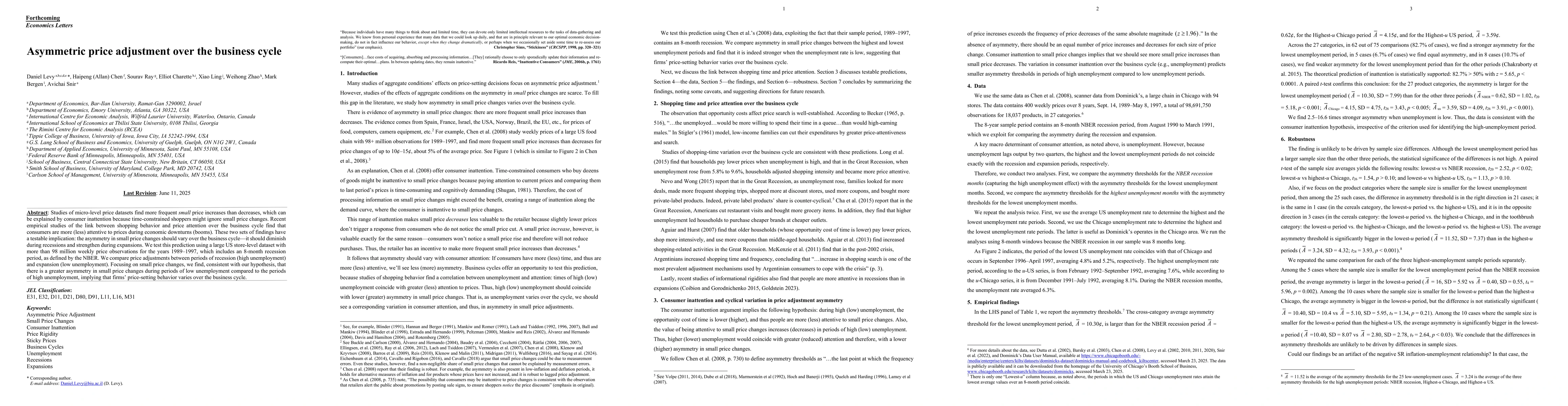

Studies of micro-level price datasets find more frequent small price increases than decreases, which can be explained by consumer inattention because time-constrained shoppers might ignore small price changes. Recent empirical studies of the link between shopping behavior and price attention over the business cycle find that consumers are more attentive to prices during economic downturns, and less attentive during economic booms. These two sets of findings have a testable implication. The asymmetry in small price changes should vary over the business cycle. It should diminish during recessions and strengthen during expansions. We test this prediction using a large US store-level dataset with more than 98 million weekly price observations for the years 1989-1997, which includes an 8-month recession period, as defined by the NBER. We compare price adjustments between periods of recession - high unemployment, and expansion - low unemployment. Focusing on small price changes, we find, consistent with our hypothesis, that there is a greater asymmetry in small price changes during periods of low unemployment compared to the periods of high unemployment, implying that firms price-setting behavior varies over the business cycle.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnemployment and Endogenous Reallocation over the Business Cycle

Carlos Carrillo-Tudela, Ludo Visschers

Stock Price Predictability and the Business Cycle via Machine Learning

Hsuan Fu, Xiuyi Fan, Li Rong Wang

No citations found for this paper.

Comments (0)