Authors

Summary

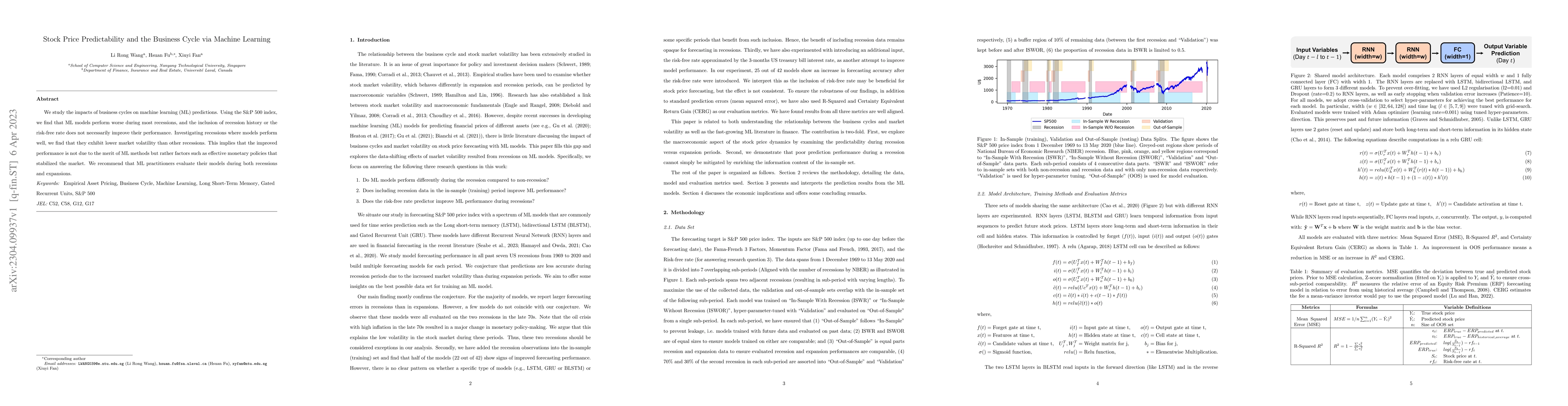

We study the impacts of business cycles on machine learning (ML) predictions. Using the S&P 500 index, we find that ML models perform worse during most recessions, and the inclusion of recession history or the risk-free rate does not necessarily improve their performance. Investigating recessions where models perform well, we find that they exhibit lower market volatility than other recessions. This implies that the improved performance is not due to the merit of ML methods but rather factors such as effective monetary policies that stabilized the market. We recommend that ML practitioners evaluate their models during both recessions and expansions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAsymmetric price adjustment over the business cycle

Xiao Ling, Avichai Snir, Daniel Levy et al.

The Predictability of Stock Price: Empirical Study onTick Data in Chinese Stock Market

Tian Lan, Xingyu Xu, Sihai Zhang et al.

Machine learning approach to stock price crash risk

Abdullah Karasan, Ozge Sezgin Alp, Gerhard-Wilhelm Weber

No citations found for this paper.

Comments (0)