Summary

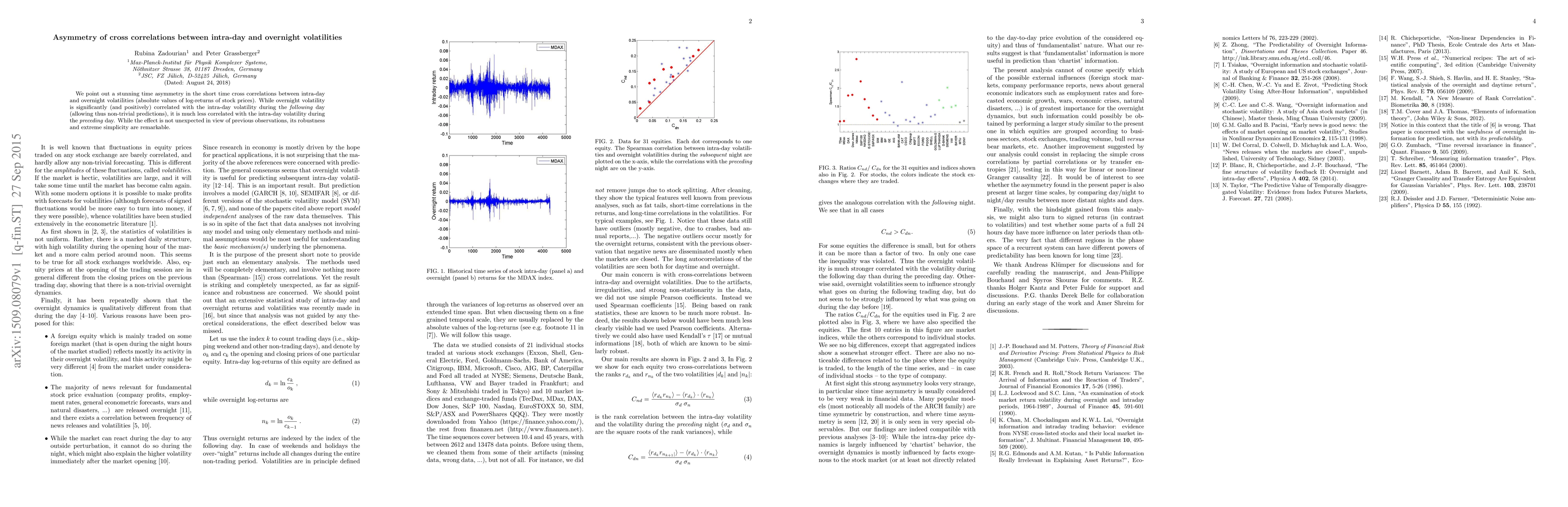

We point out a stunning time asymmetry in the short time cross correlations between intra-day and overnight volatilities (absolute values of log-returns of stock prices). While overnight volatility is significantly (and positively) correlated with the intra-day volatility during the \textit{following} day (allowing thus non-trivial predictions), it is much less correlated with the intra-day volatility during the \textit{preceding} day. While the effect is not unexpected in view of previous observations, its robustness and extreme simplicity are remarkable.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHeterogeneous drivers of overnight and same-day visits

Piercesare Secchi, Francesco Scotti, Andrea Flori et al.

Dissipation, quantum coherence, and asymmetry of finite-time cross-correlations

Tan Van Vu, Keiji Saito, Van Tuan Vo

| Title | Authors | Year | Actions |

|---|

Comments (0)