Summary

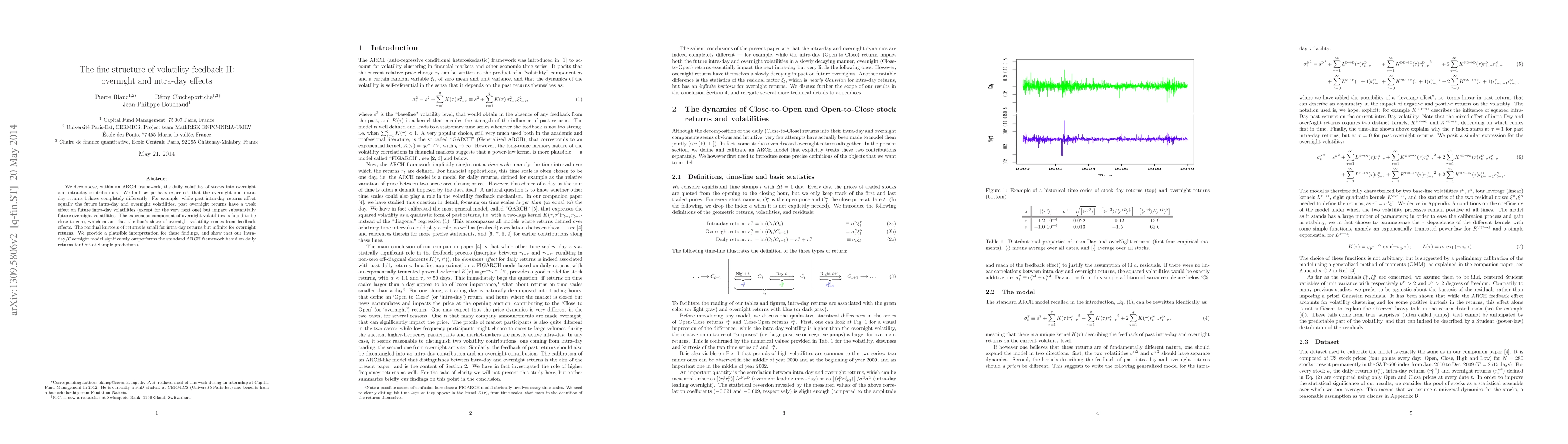

We decompose, within an ARCH framework, the daily volatility of stocks into overnight and intra-day contributions. We find, as perhaps expected, that the overnight and intra-day returns behave completely differently. For example, while past intra-day returns affect equally the future intra-day and overnight volatilities, past overnight returns have a weak effect on future intra-day volatilities (except for the very next one) but impact substantially future overnight volatilities. The exogenous component of overnight volatilities is found to be close to zero, which means that the lion's share of overnight volatility comes from feedback effects. The residual kurtosis of returns is small for intra-day returns but infinite for overnight returns. We provide a plausible interpretation for these findings, and show that our Intra-Day/Overnight model significantly outperforms the standard ARCH framework based on daily returns for Out-of-Sample predictions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)