Summary

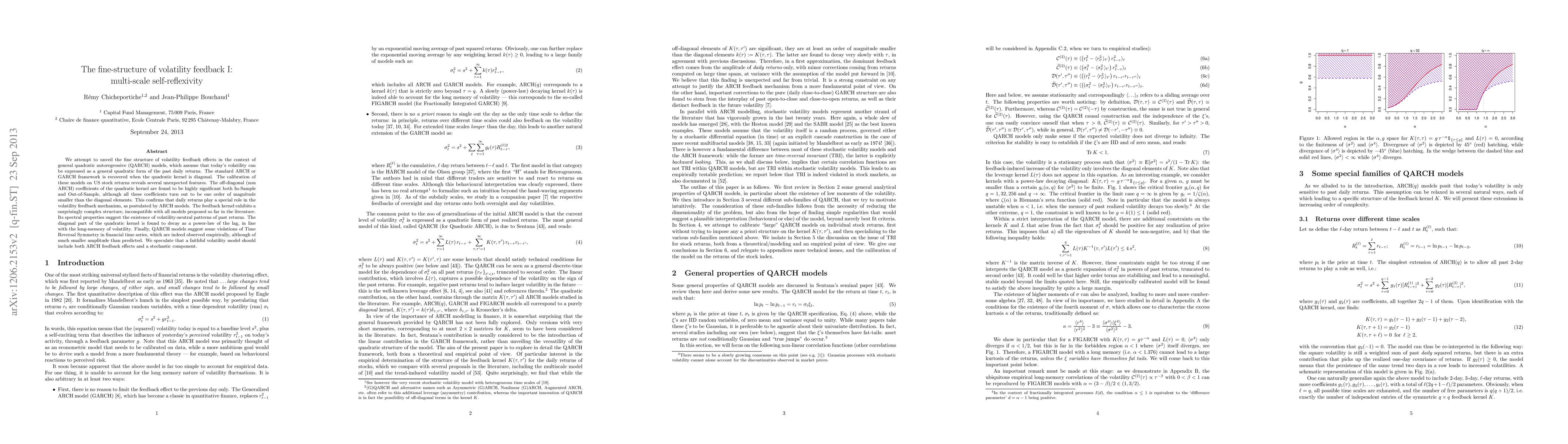

We attempt to unveil the fine structure of volatility feedback effects in the context of general quadratic autoregressive (QARCH) models, which assume that today's volatility can be expressed as a general quadratic form of the past daily returns. The standard ARCH or GARCH framework is recovered when the quadratic kernel is diagonal. The calibration of these models on US stock returns reveals several unexpected features. The off-diagonal (non ARCH) coefficients of the quadratic kernel are found to be highly significant both In-Sample and Out-of-Sample, but all these coefficients turn out to be one order of magnitude smaller than the diagonal elements. This confirms that daily returns play a special role in the volatility feedback mechanism, as postulated by ARCH models. The feedback kernel exhibits a surprisingly complex structure, incompatible with models proposed so far in the literature. Its spectral properties suggest the existence of volatility-neutral patterns of past returns. The diagonal part of the quadratic kernel is found to decay as a power-law of the lag, in line with the long-memory of volatility. Finally, QARCH models suggest some violations of Time Reversal Symmetry in financial time series, which are indeed observed empirically, although of much smaller amplitude than predicted. We speculate that a faithful volatility model should include both ARCH feedback effects and a stochastic component.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)