Summary

In an incomplete model, where under an appropriate num\'eraire, the stock price process is driven by a sigma-bounded semimartingale, we investigate the behavior of the expected utility maximization problem under small perturbations of the num\'eraire. We establish a quadratic approximation of the value function and a first-order expansion of the terminal wealth. Relying on a description of the base return process in terms of its semimartingale characteristics, we also construct wealth processes and nearly optimal strategies that allow for matching the primal value function up to the second order. We also link perturbations of the num\'eraire to distortions of the finite-variation part and martingale part of the stock price return and characterize the asymptotic expansions in terms of the risk-tolerance wealth process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

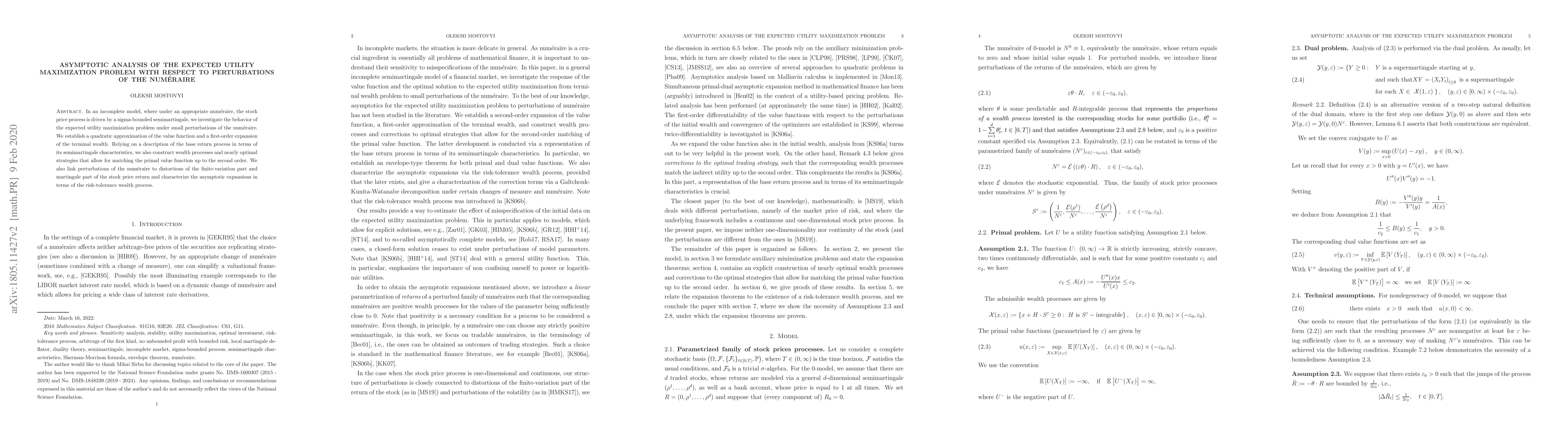

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFair pricing and hedging under small perturbations of the num\'eraire on a finite probability space

Alexey Pozdnyakov, Oleksii Mostovyi, William Busching et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)