Summary

In this note, we study the utility maximization problem on the terminal wealth under proportional transaction costs and bounded random endowment. In particular, we restrict ourselves to the num\'eraire-based model and work with utility functions only supporting R+. Under the assumption of existence of consistent price systems and natural regularity conditions, standard convex duality results are established. Precisely, we first enlarge the dual domain from the collection of martingale densities associated with consistent price systems to a set of finitely additive measures; then the dual formulation of the utility maximization problem can be regarded as an extension of the paper of Cvitani\'c-Schachermayer-Wang (2001) to the context under proportional transaction costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

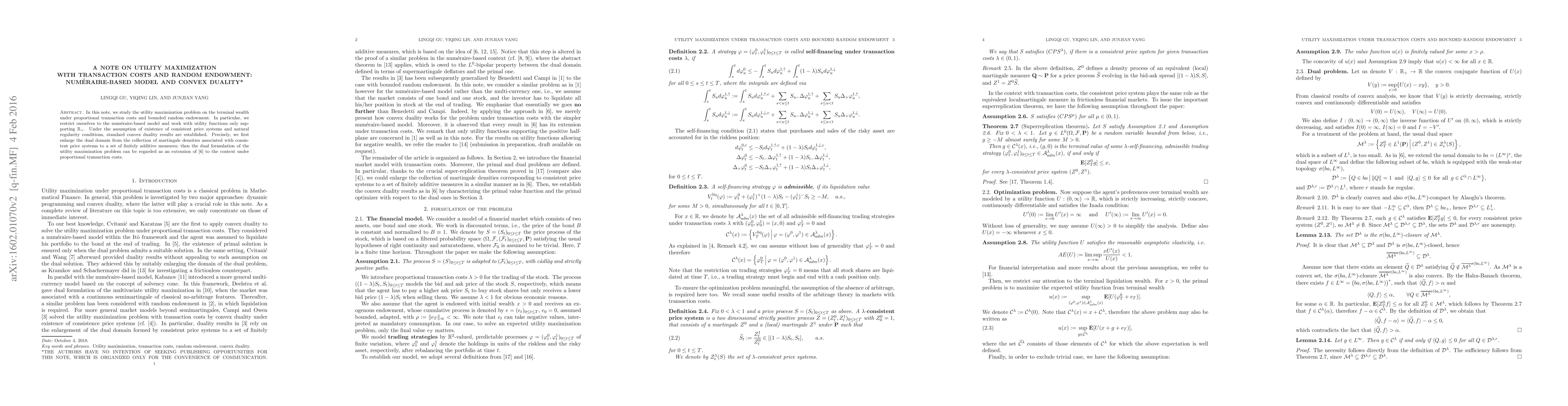

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)