Summary

We consider a discrete time financial market with proportional transaction costs under model uncertainty, and study a num\'eraire-based semi-static utility maximization problem with an exponential utility preference. The randomization techniques recently developed in \cite{BDT17} allow us to transform the original problem into a frictionless counterpart on an enlarged space. By suggesting a different dynamic programming argument than in \cite{bartl2016exponential}, we are able to prove the existence of the optimal strategy and the convex duality theorem in our context with transaction costs. In the frictionless framework, this alternative dynamic programming argument also allows us to generalize the main results in \cite{bartl2016exponential} to a weaker market condition. Moreover, as an application of the duality representation, some basic features of utility indifference prices are investigated in our robust setting with transaction costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

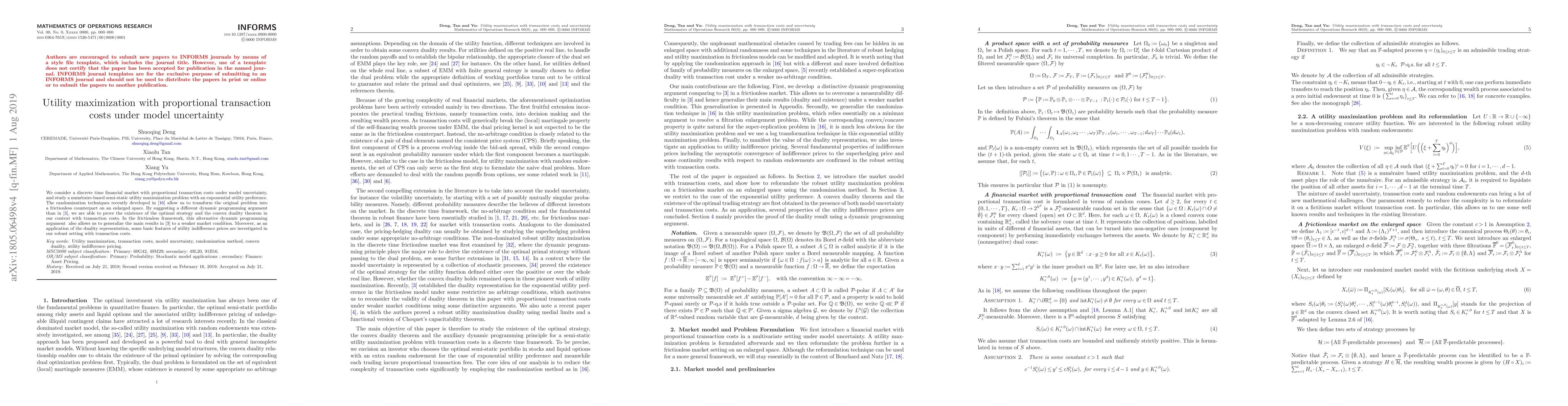

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)