Summary

We present an optimal investment theorem for a currency exchange model with random and possibly discontinuous proportional transaction costs. The investor's preferences are represented by a multivariate utility function, allowing for simultaneous consumption of any prescribed selection of the currencies at a given terminal date. We prove the existence of an optimal portfolio process under the assumption of asymptotic satiability of the value function. Sufficient conditions for asymptotic satiability of the value function include reasonable asymptotic elasticity of the utility function, or a growth condition on its dual function. We show that the portfolio optimization problem can be reformulated in terms of maximization of a terminal liquidation utility function, and that both problems have a common optimizer.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

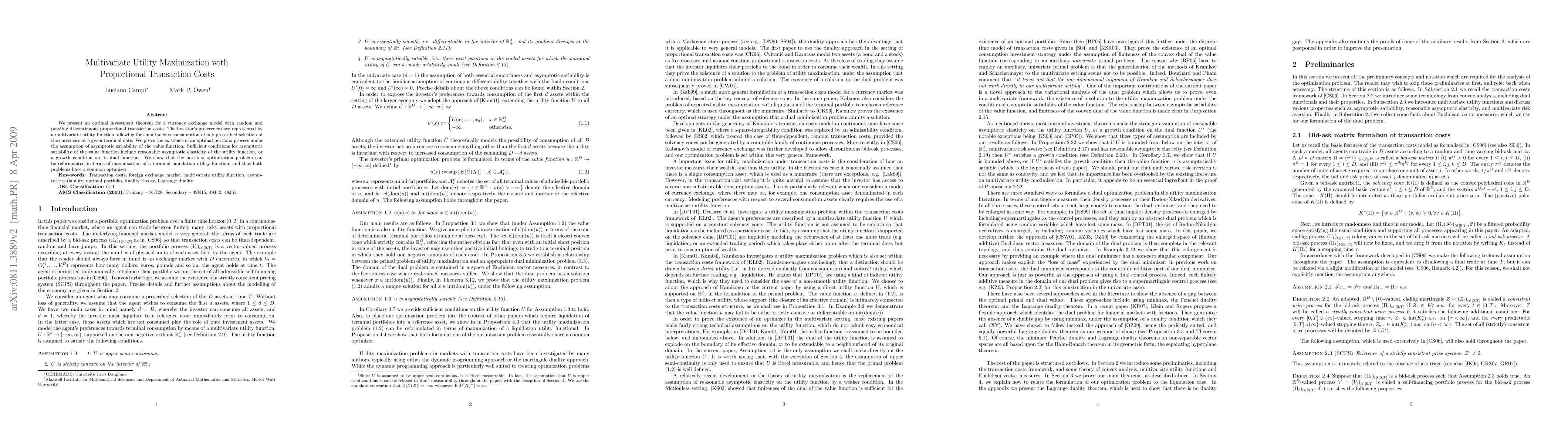

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)