Summary

The asymptotic behavior of the implied volatility associated with a general call pricing function has been extensively studied in the last decade. The main topics discussed in this paper are Lee's moment formulas for the implied volatility, and Piterbarg's conjecture, describing how the implied volatility behaves in the case where all the moments of the stock price are finite. We find various conditions guaranteeing the existence of the limit in Lee's moment formulas. We also prove a modified version of Piterbarg's conjecture and provide a non-restrictive sufficient condition for the validity of this conjecture in its original form. The asymptotic formulas obtained in the paper are applied to the implied volatility in the CEV model and in the Heston model perturbed by a compound Poisson process with double exponential law for jump sizes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

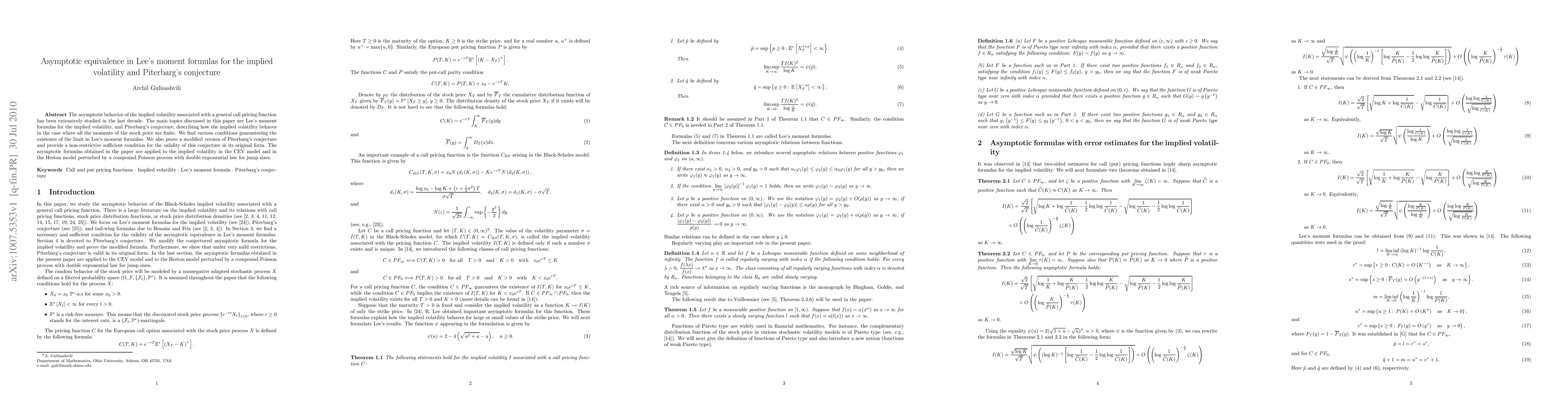

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSmile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

| Title | Authors | Year | Actions |

|---|

Comments (0)