Summary

We revisit the foundational Moment Formula proved by Roger Lee fifteen years ago. We show that when the underlying stock price martingale admits finite log-moments E[|log(S)|^q] for some positive q, the arbitrage-free growth in the left wing of the implied volatility smile is less constrained than Lee's bound. The result is rationalised by a market trading discretely monitored variance swaps wherein the payoff is a function of squared log-returns, and requires no assumption for the underlying martingale to admit any negative moment. In this respect, the result can derived from a model-independent setup. As a byproduct, we relax the moment assumptions on the stock price to provide a new proof of the notorious Gatheral-Fukasawa formula expressing variance swaps in terms of the implied volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

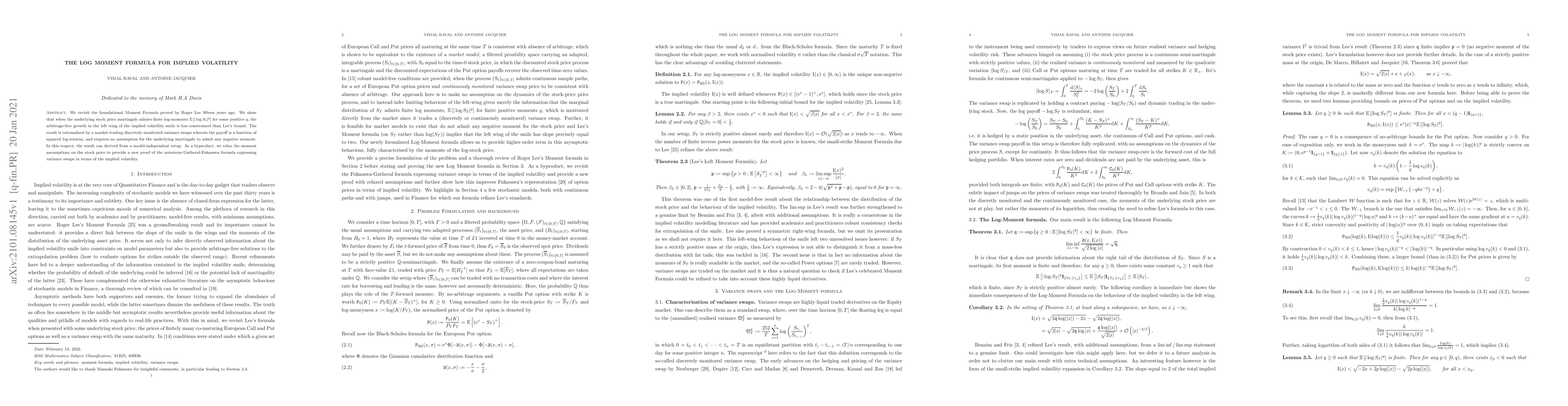

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)