Summary

In a model driven by a multi-dimensional local diffusion, we study the behavior of implied volatility {\sigma} and its derivatives with respect to log-strike k and maturity T near expiry and at the money. We recover explicit limits of these derivatives for (T,k) approaching the origin within the parabolic region |x-k|^2 < {\lambda} T, with x denoting the spot log-price of the underlying asset and where {\lambda} is a positive and arbitrarily large constant. Such limits yield the exact Taylor formula for implied volatility within the parabola |x-k|^2 < {\lambda} T. In order to include important models of interest in mathematical finance, e.g. Heston, CEV, SABR, the analysis is carried out under the assumption that the infinitesimal generator of the diffusion is only locally elliptic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

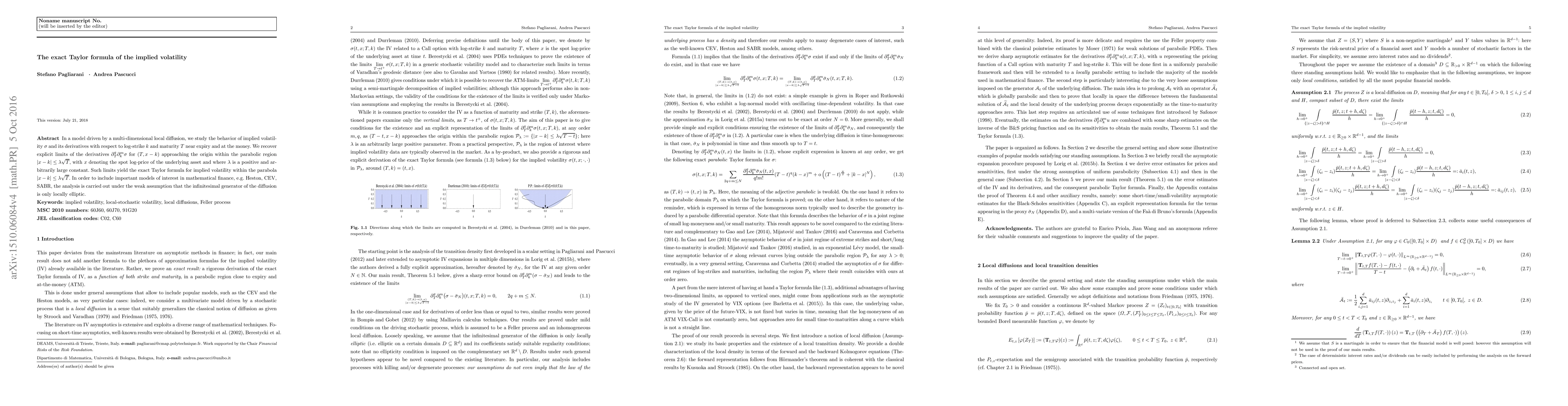

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe ATM implied volatility slope, the (dual) volatility swap, and the (dual) zero vanna implied volatility

Frido Rolloos

On the implied volatility of Asian options under stochastic volatility models

Elisa Alòs, Eulalia Nualart, Makar Pravosud

| Title | Authors | Year | Actions |

|---|

Comments (0)