Summary

In this paper we study the small noise asymptotic expansions for certain classes of local volatility models arising in finance. We provide explicit expressions for the involved coefficients as well as accurate estimates on the remainders. Moreover, we perform a detailed numerical analysis, with accuracy comparisons, of the obtained results by mean of the standard Monte Carlo technique as well as exploiting the polynomial Chaos Expansion approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

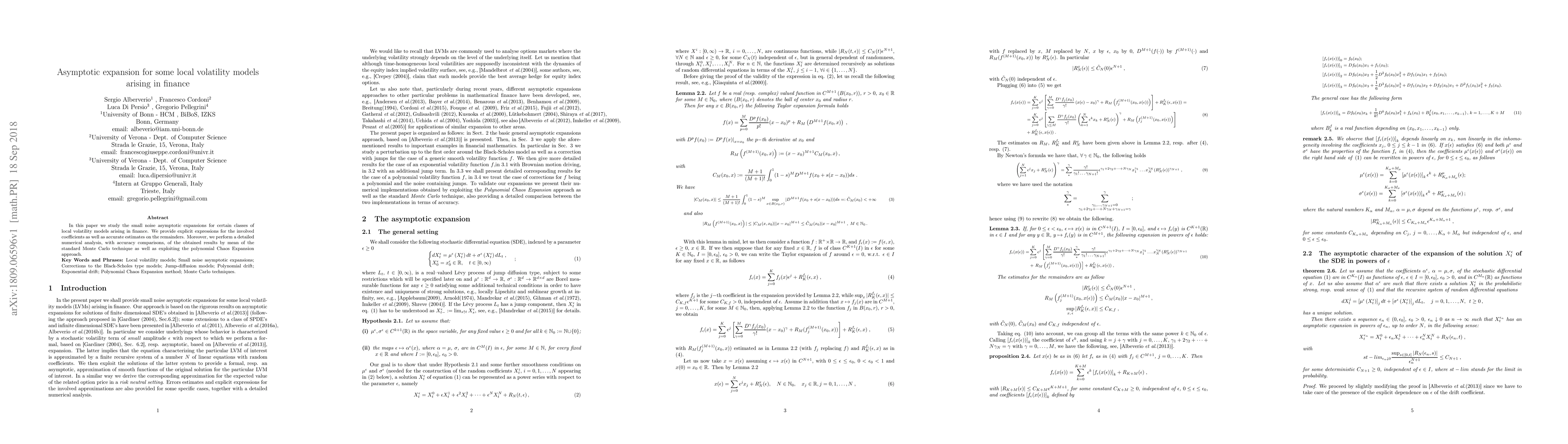

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)