Summary

We consider a stochastic game-theoretic model of a discrete-time asset market with short-lived assets and endogenous asset prices. We prove that the strategy which invests in the assets proportionally to their expected relative payoffs asymptotically minimizes the expected time needed to reach a large wealth level. The result is obtained under the assumption that the relative asset payoffs and the growth rate of the total payoff during each time period are independent and identically distributed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

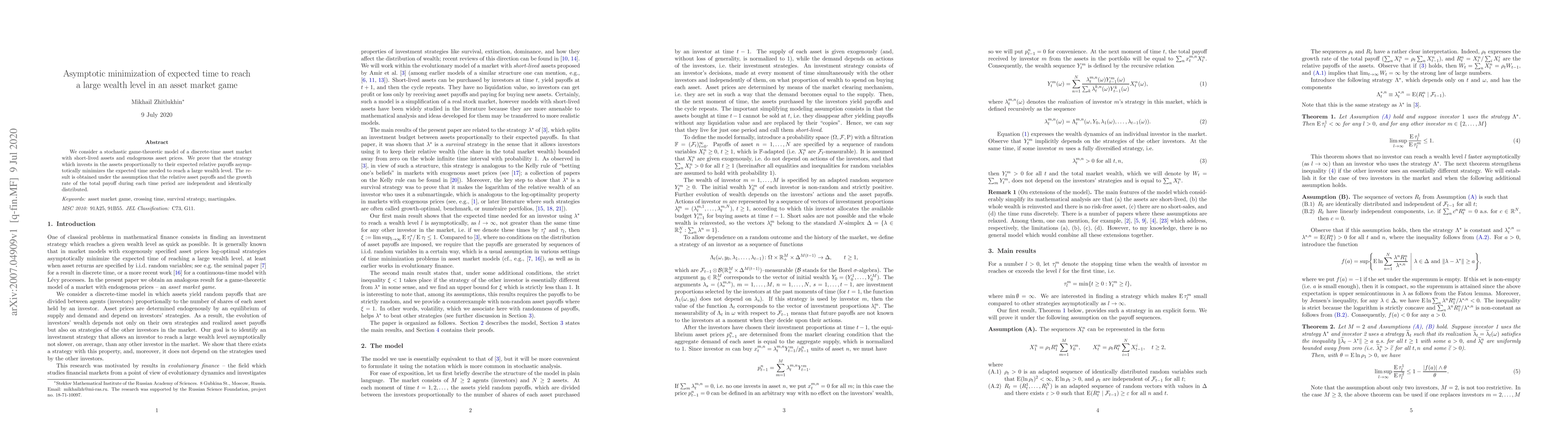

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)