Summary

We consider a continuous-time game-theoretic model of an investment market with short-lived assets and endogenous asset prices. The first goal of the paper is to formulate a stochastic equation which determines wealth processes of investors and to provide conditions for the existence of its solution. The second goal is to show that there exists a strategy such that the logarithm of the relative wealth of an investor who uses it is a submartingale regardless of the strategies of the other investors, and the relative wealth of any other essentially different strategy vanishes asymptotically. This strategy can be considered as an optimal growth portfolio in the model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

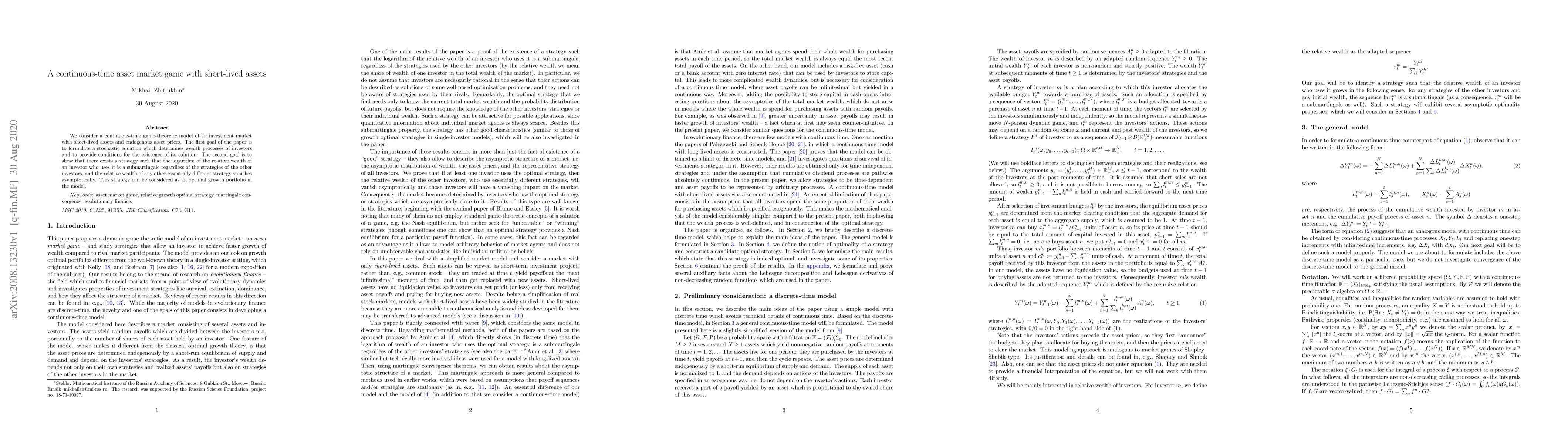

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)