Authors

Summary

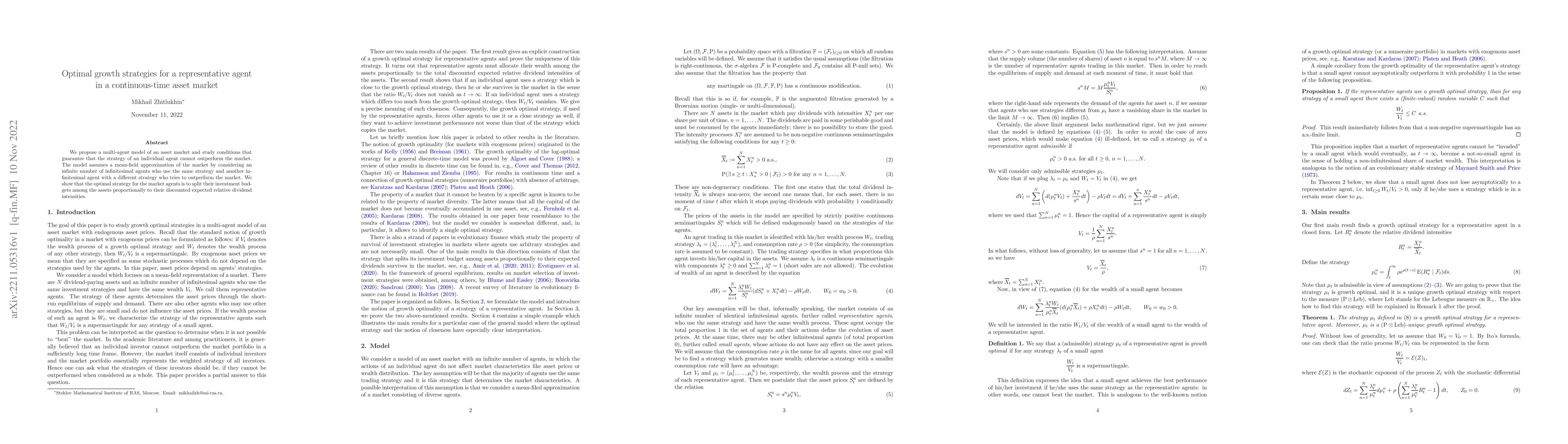

We propose a multi-agent model of an asset market and study conditions that guarantee that the strategy of an individual agent cannot outperform the market. The model assumes a mean-field approximation of the market by considering an infinite number of infinitesimal agents who use the same strategy and another infinitesimal agent with a different strategy who tries to outperform the market. We show that the optimal strategy for the market agents is to split their investment budgets among the assets proportionally to their discounted expected relative dividend intensities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)