Summary

The double Heston model is one of the most popular option pricing models in financial theory. It is applied to several issues such that risk management and volatility surface calibration. This paper deals with the problem of global parameter estimations in this model. Our main stochastic results are about the stationarity and the ergodicity of the double Heston process. The statistical part of this paper is about the maximum likelihood and the conditional least squares estimations based on continuous-time observations; then for each estimation method, we study the asymptotic properties of the resulted estimators in the ergodic case.

AI Key Findings

Generated Jun 13, 2025

Methodology

The paper employs stochastic analysis and asymptotic theory to study the double Heston model, focusing on parameter estimation through maximum likelihood and conditional least squares methods based on continuous-time observations.

Key Results

- The paper establishes the stationarity and ergodicity of the double Heston process.

- Asymptotic properties of maximum likelihood and conditional least squares estimators for the drift parameters are derived in the ergodic case.

- Strong consistency and asymptotic normality of both estimators are proven under certain conditions.

Significance

This research is significant for financial modeling and option pricing, providing robust methods for parameter estimation in the double Heston model, which is crucial for risk management and volatility surface calibration.

Technical Contribution

The paper presents detailed asymptotic results for parameter estimations in the double Heston model, contributing to the theoretical understanding of stochastic processes in finance.

Novelty

The work introduces a comprehensive analysis of the asymptotic properties of estimators for the double Heston model, offering insights that go beyond existing literature focused primarily on the single Heston model.

Limitations

- The study assumes ergodicity, which may not always hold in practical financial applications.

- Simulations are limited to specific parameter settings, and generalization to broader scenarios may require further investigation.

Future Work

- Extending the analysis to non-ergodic cases could broaden the applicability of the findings.

- Investigating the performance of these estimators under different market conditions and with more complex models.

Paper Details

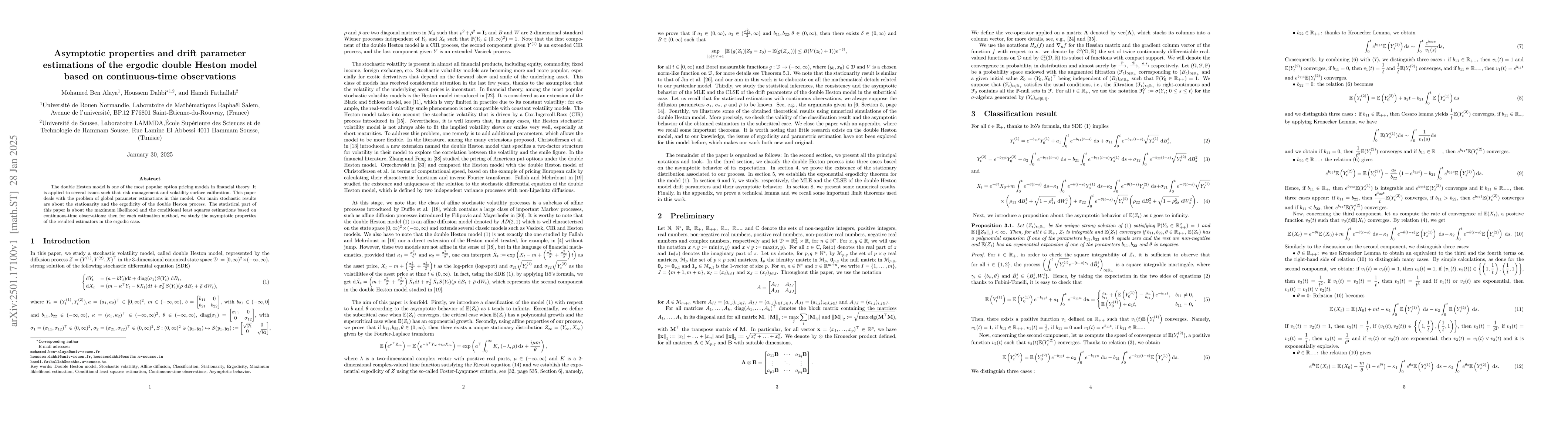

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)