Authors

Summary

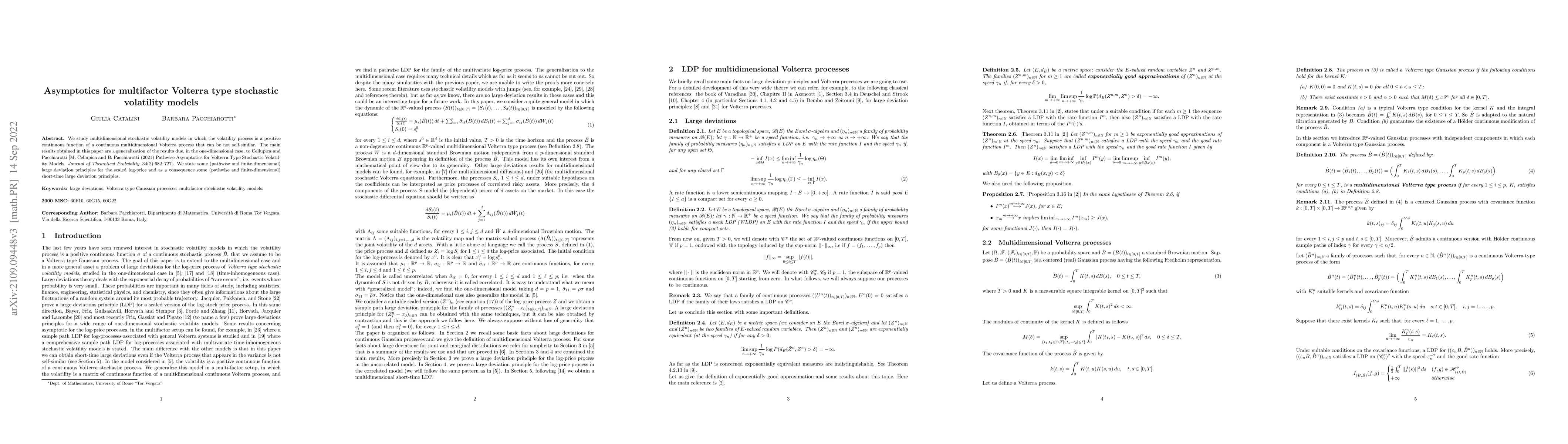

We study multidimensional stochastic volatility models in which the volatility process is a positive continuous function of a continuous multidimensional Volterra process that can be not self-similar. The main results obtained in this paper are a generalization of the results due, in the one-dimensional case, to Cellupica and Pacchiarotti [M. Cellupica and B. Pacchiarotti (2021) Pathwise Asymptotics for Volterra Type Stochastic Volatility Models. Journal of Theoretical Probability, 34(2):682--727]. We state some (pathwise and finite-dimensional) large deviation principles for the scaled log-price and as a consequence some (pathwise and finite-dimensional) short-time large deviation principles.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)