Summary

We present a new methodology to analyze large classes of (classical and rough) stochastic volatility models, with special regard to short-time and small noise formulae for option prices. Our main tool is the theory of regularity structures, which we use in the form of [Bayer et al; A regularity structure for rough volatility, 2017]. In essence, we implement a Laplace method on the space of models (in the sense of Hairer), which generalizes classical works of Azencott and Ben Arous on path space and then Aida, Inahama--Kawabi on rough path space. When applied to rough volatility models, e.g. in the setting of [Forde-Zhang, Asymptotics for rough stochastic volatility models, 2017], one obtains precise asymptotic for European options which refine known large deviation asymptotics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

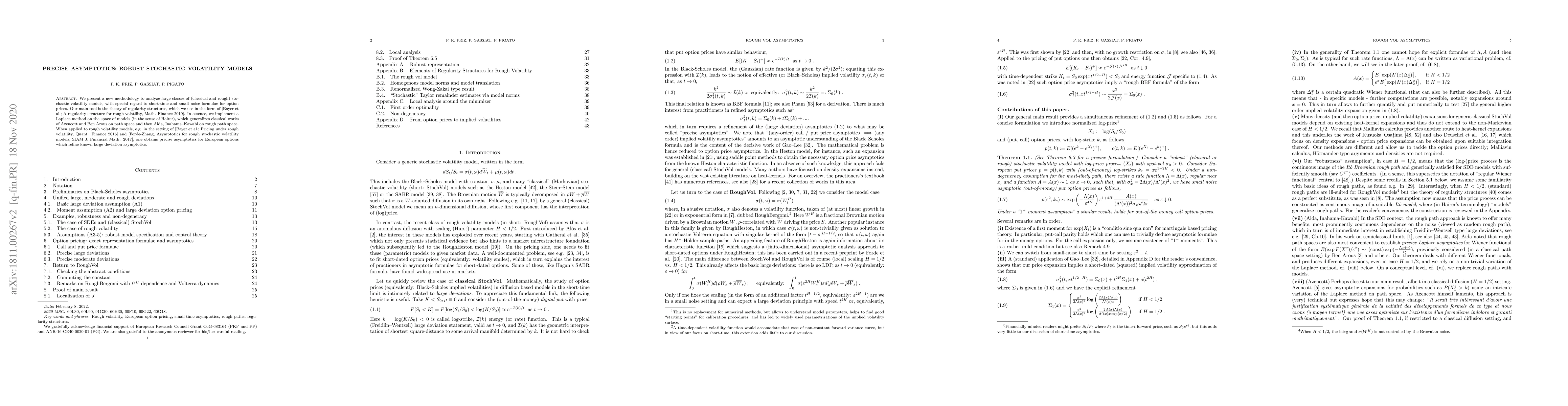

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAsymptotics for multifactor Volterra type stochastic volatility models

Barbara Pacchiarotti, Giulia Catalini

Short-maturity asymptotics for VIX and European options in local-stochastic volatility models

Xiaoyu Wang, Dan Pirjol, Lingjiong Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)