Summary

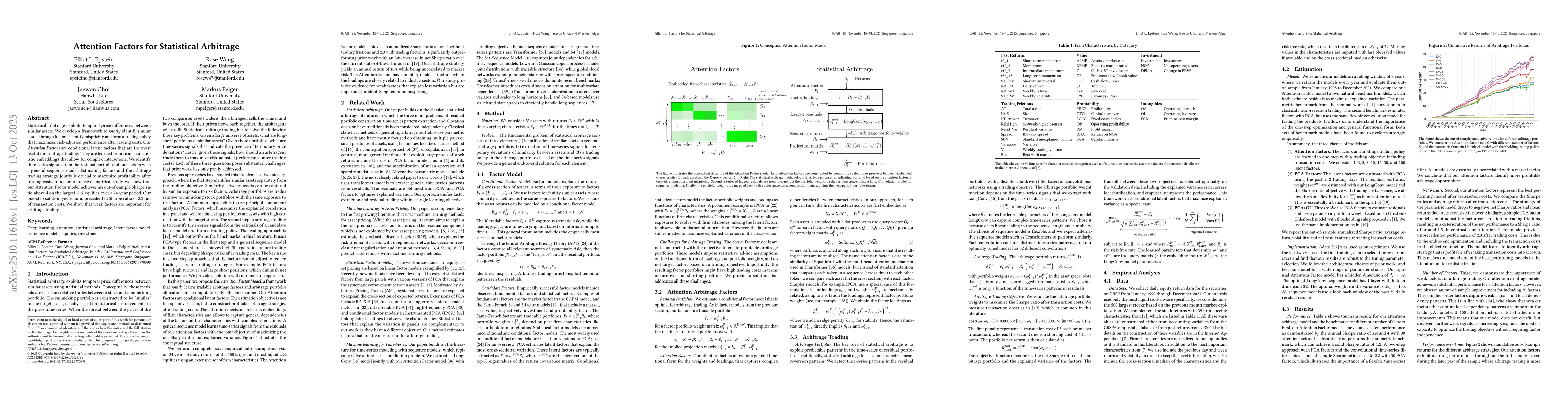

Statistical arbitrage exploits temporal price differences between similar assets. We develop a framework to jointly identify similar assets through factors, identify mispricing and form a trading policy that maximizes risk-adjusted performance after trading costs. Our Attention Factors are conditional latent factors that are the most useful for arbitrage trading. They are learned from firm characteristic embeddings that allow for complex interactions. We identify time-series signals from the residual portfolios of our factors with a general sequence model. Estimating factors and the arbitrage trading strategy jointly is crucial to maximize profitability after trading costs. In a comprehensive empirical study we show that our Attention Factor model achieves an out-of-sample Sharpe ratio above 4 on the largest U.S. equities over a 24-year period. Our one-step solution yields an unprecedented Sharpe ratio of 2.3 net of transaction costs. We show that weak factors are important for arbitrage trading.

AI Key Findings

Generated Oct 31, 2025

Methodology

The paper proposes an AttentionFactor model for statistical arbitrage, combining latent factor estimation with sequence modeling using LongConv. It employs a one-step estimation framework to identify similar assets and allocate arbitrage portfolios based on time-series patterns.

Key Results

- The model achieves state-of-the-art performance under realistic trading frictions

- It captures complex dependencies in firm characteristics through conditional latent attention factors

- The one-step estimation maximizes portfolio performance after accounting for trading frictions

Significance

This research sets a new standard in statistical arbitrage by providing an effective framework for identifying arbitrage opportunities and optimizing portfolio allocations in real-world market conditions.

Technical Contribution

Develops a one-step estimation framework for latent factors that integrates time-series patterns and conditional latent attention factors for complex dependency capture

Novelty

Introduces conditional latent attention factors and a one-step estimation approach that maximizes portfolio performance while accounting for trading frictions, distinguishing it from traditional factor models and sequential estimation methods.

Limitations

- The model's performance depends on the quality and quantity of historical data

- It may struggle with extreme market events or sudden regime shifts

Future Work

- Exploring the application of the model to other financial markets

- Investigating the integration of real-time data and adaptive learning mechanisms

Paper Details

PDF Preview

Similar Papers

Found 5 papersDeep Learning Statistical Arbitrage

Markus Pelger, Greg Zanotti, Jorge Guijarro-Ordonez

Statistical Arbitrage for Multiple Co-Integrated Stocks

A. Papanicolaou, T. N. Li

Comments (0)