Summary

We study the problem of selling a resource through an auction mechanism. The winning buyer in turn develops this resource to generate profit. Two forms of payment are considered: charging the winning buyer a one-time payment, or an initial payment plus a profit sharing contract (PSC). We consider a symmetric interdependent values model with risk averse or risk neutral buyers and a risk neutral seller. For the second price auction and the English auction, we show that the seller's expected total revenue from the auction where he also takes a fraction of the positive profit is higher than the expected revenue from the auction with only a one-time payment. Moreover, the seller can generate an even higher expected total revenue if, in addition to taking a fraction of the positive profit, he also takes the same fraction of any loss incurred from developing the resource. Moving beyond simple PSCs, we show that the auction with a PSC from a very general class generates higher expected total revenue than the auction with only a one-time payment. Finally, we show that suitable PSCs provide higher expected total revenue than a one-time payment even when the incentives of the winning buyer to develop the resource must be addressed by the seller.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

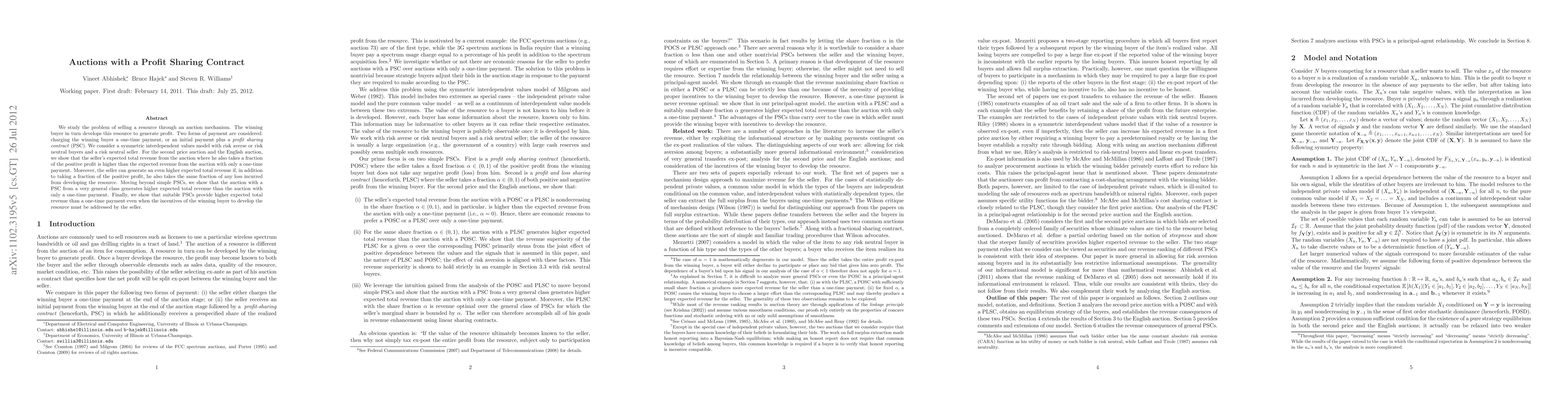

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)