Summary

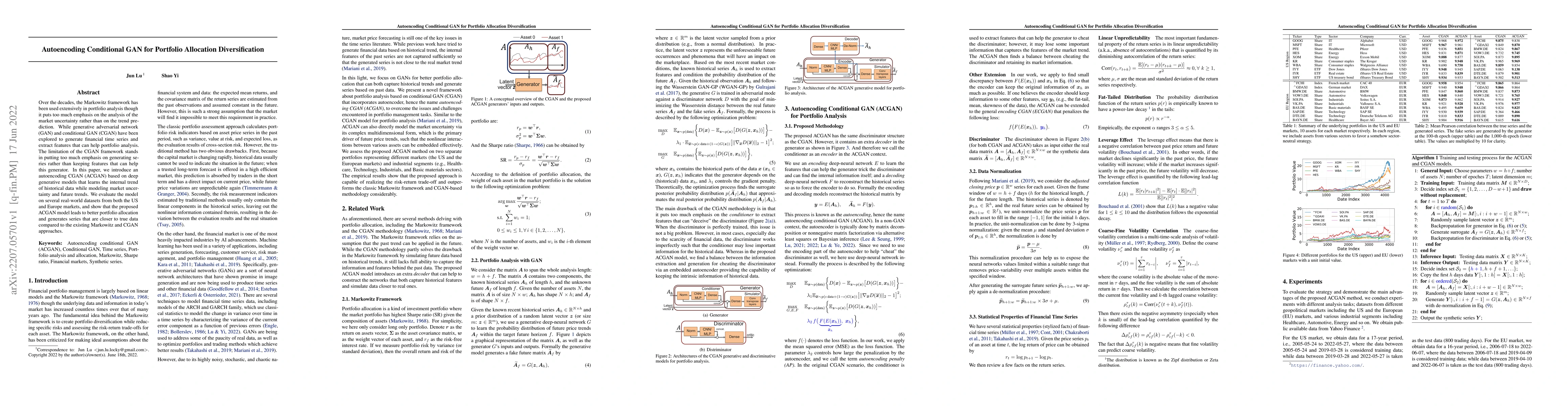

Over the decades, the Markowitz framework has been used extensively in portfolio analysis though it puts too much emphasis on the analysis of the market uncertainty rather than on the trend prediction. While generative adversarial network (GAN) and conditional GAN (CGAN) have been explored to generate financial time series and extract features that can help portfolio analysis. The limitation of the CGAN framework stands in putting too much emphasis on generating series rather than keeping features that can help this generator. In this paper, we introduce an autoencoding CGAN (ACGAN) based on deep generative models that learns the internal trend of historical data while modeling market uncertainty and future trends. We evaluate the model on several real-world datasets from both the US and Europe markets, and show that the proposed ACGAN model leads to better portfolio allocation and generates series that are closer to true data compared to the existing Markowitz and CGAN approaches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)