Summary

A new framework for portfolio diversification is introduced which goes beyond the classical mean-variance approach and portfolio allocation strategies such as risk parity. It is based on a novel concept called portfolio dimensionality that connects diversification to the non-Gaussianity of portfolio returns and can typically be defined in terms of the ratio of risk measures which are homogenous functions of equal degree. The latter arises naturally due to our requirement that diversification measures should be leverage invariant. We introduce this new framework and argue the benefits relative to existing measures of diversification in the literature, before addressing the question of optimizing diversification or, equivalently, dimensionality. Maximising portfolio dimensionality leads to highly non-trivial optimization problems with objective functions which are typically non-convex and potentially have multiple local optima. Two complementary global optimization algorithms are thus presented. For problems of moderate size and more akin to asset allocation problems, a deterministic Branch and Bound algorithm is developed, whereas for problems of larger size a stochastic global optimization algorithm based on Gradient Langevin Dynamics is given. We demonstrate analytically and through numerical experiments that the framework reflects the desired properties often discussed in the literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

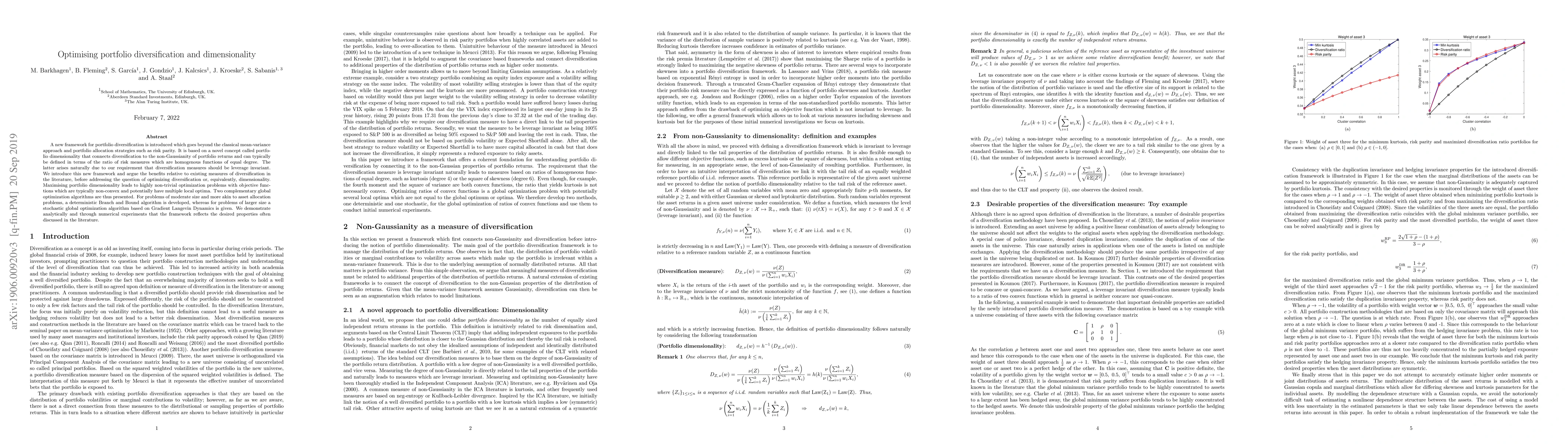

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)