Authors

Summary

The mean-variance portfolio that considers the trade-off between expected return and risk has been widely used in the problem of asset allocation for multi-asset portfolios. However, since it is difficult to estimate the expected return and the out-of-sample performance of the mean-variance portfolio is poor, risk-based portfolio construction methods focusing only on risk have been proposed, and are attracting attention mainly in practice. In terms of risk, asset fluctuations that make up the portfolio are thought to have common factors behind them, and principal component analysis, which is a dimension reduction method, is applied to extract the factors. In this study, we propose the Schr\"{o}dinger risk diversification portfolio as a factor risk diversifying portfolio using Schr\"{o}dinger principal component analysis that applies the Schr\"{o}dinger equation in quantum mechanics. The Schr\"{o}dinger principal component analysis can accurately estimate the factors even if the sample points are unequally spaced or in a small number, thus we can make efficient risk diversification. The proposed method was verified to outperform the conventional risk parity and other risk diversification portfolio constructions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

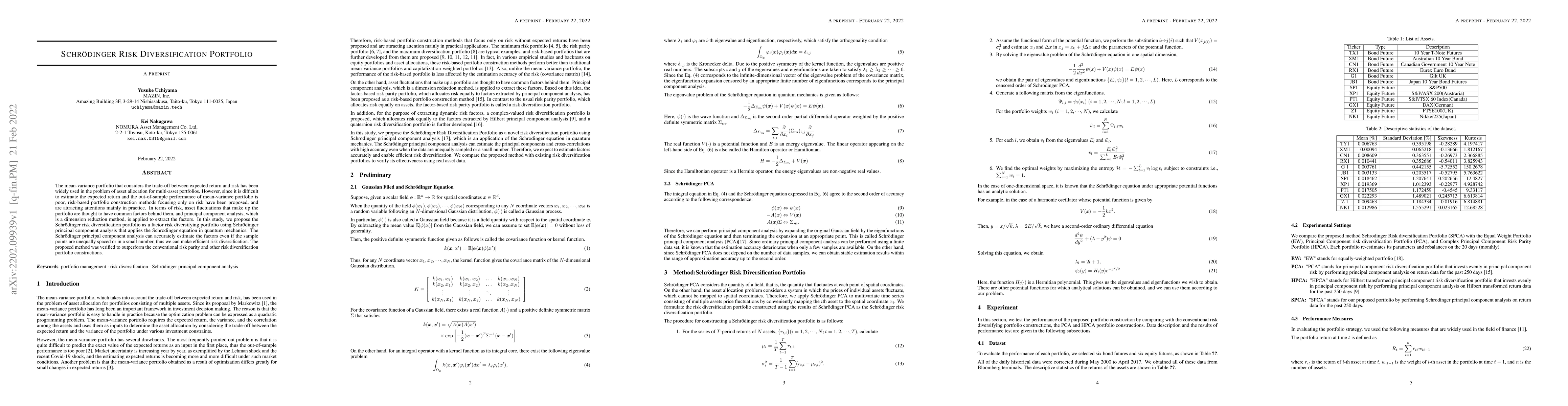

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)