Authors

Summary

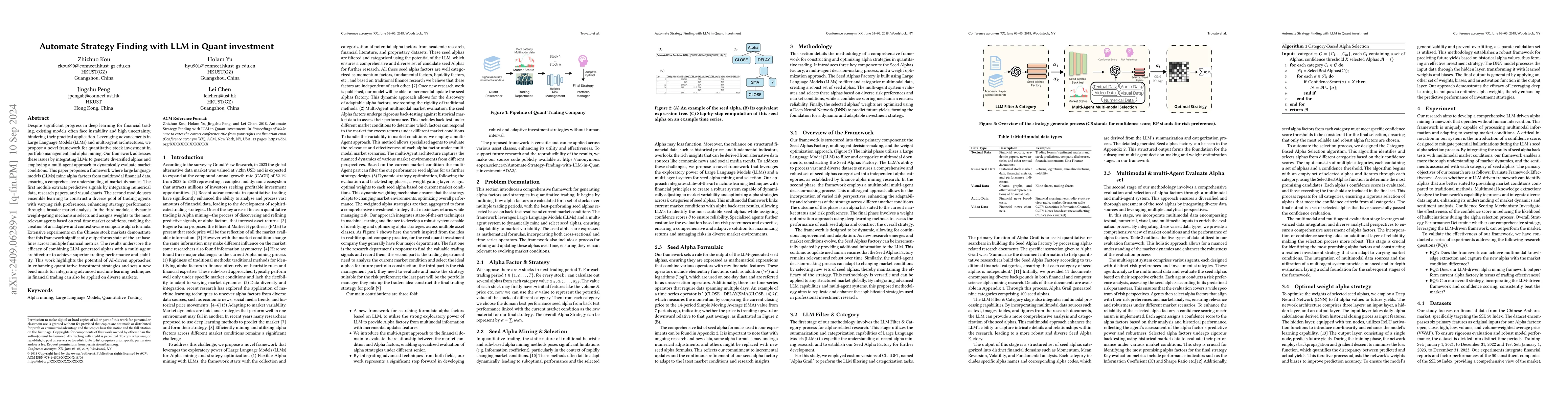

Despite significant progress in deep learning for financial trading, existing models often face instability and high uncertainty, hindering their practical application. Leveraging advancements in Large Language Models (LLMs) and multi-agent architectures, we propose a novel framework for quantitative stock investment in portfolio management and alpha mining. Our framework addresses these issues by integrating LLMs to generate diversified alphas and employing a multi-agent approach to dynamically evaluate market conditions. This paper proposes a framework where large language models (LLMs) mine alpha factors from multimodal financial data, ensuring a comprehensive understanding of market dynamics. The first module extracts predictive signals by integrating numerical data, research papers, and visual charts. The second module uses ensemble learning to construct a diverse pool of trading agents with varying risk preferences, enhancing strategy performance through a broader market analysis. In the third module, a dynamic weight-gating mechanism selects and assigns weights to the most relevant agents based on real-time market conditions, enabling the creation of an adaptive and context-aware composite alpha formula. Extensive experiments on the Chinese stock markets demonstrate that this framework significantly outperforms state-of-the-art baselines across multiple financial metrics. The results underscore the efficacy of combining LLM-generated alphas with a multi-agent architecture to achieve superior trading performance and stability. This work highlights the potential of AI-driven approaches in enhancing quantitative investment strategies and sets a new benchmark for integrating advanced machine learning techniques in financial trading can also be applied on diverse markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuant 4.0: Engineering Quantitative Investment with Automated, Explainable and Knowledge-driven Artificial Intelligence

Jian Guo, Heung-Yeung Shum, Saizhuo Wang et al.

Exposing Product Bias in LLM Investment Recommendation

Xiaoyu Zhang, Shiqing Ma, Chao Shen et al.

Conditional investment strategy in evolutionary trust games with repeated group interactions

Linjie Liu, Xiaojie Chen

| Title | Authors | Year | Actions |

|---|

Comments (0)