Authors

Summary

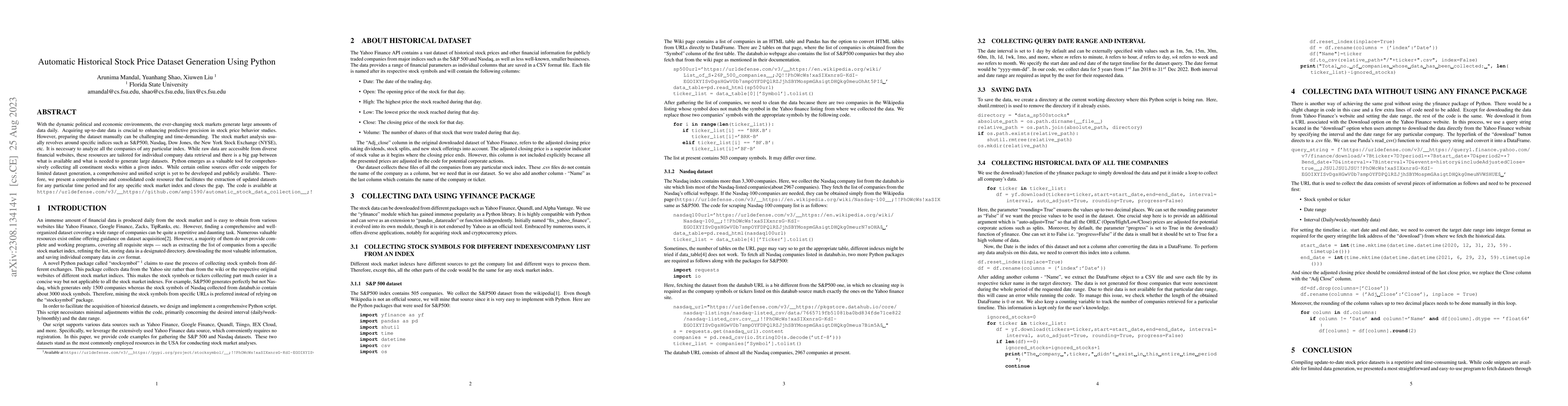

With the dynamic political and economic environments, the ever-changing stock markets generate large amounts of data daily. Acquiring up-to-date data is crucial to enhancing predictive precision in stock price behavior studies. However, preparing the dataset manually can be challenging and time-demanding. The stock market analysis usually revolves around specific indices such as S&P500, Nasdaq, Dow Jones, the New York Stock Exchange (NYSE), etc. It is necessary to analyze all the companies of any particular index. While raw data are accessible from diverse financial websites, these resources are tailored for individual company data retrieval and there is a big gap between what is available and what is needed to generate large datasets. Python emerges as a valuable tool for comprehensively collecting all constituent stocks within a given index. While certain online sources offer code snippets for limited dataset generation, a comprehensive and unified script is yet to be developed and publicly available. Therefore, we present a comprehensive and consolidated code resource that facilitates the extraction of updated datasets for any particular time period and for any specific stock market index and closes the gap. The code is available at https://github.com/amp1590/automatic_stock_data_collection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGAP-Gen: Guided Automatic Python Code Generation

Junlin Wang, Yurun Song, Junchen Zhao et al.

DSE Stock Price Prediction using Hidden Markov Model

Md. Golam Rabiul Alam, Md Tanvir Rouf Shawon, Raihan Tanvir

No citations found for this paper.

Comments (0)