Summary

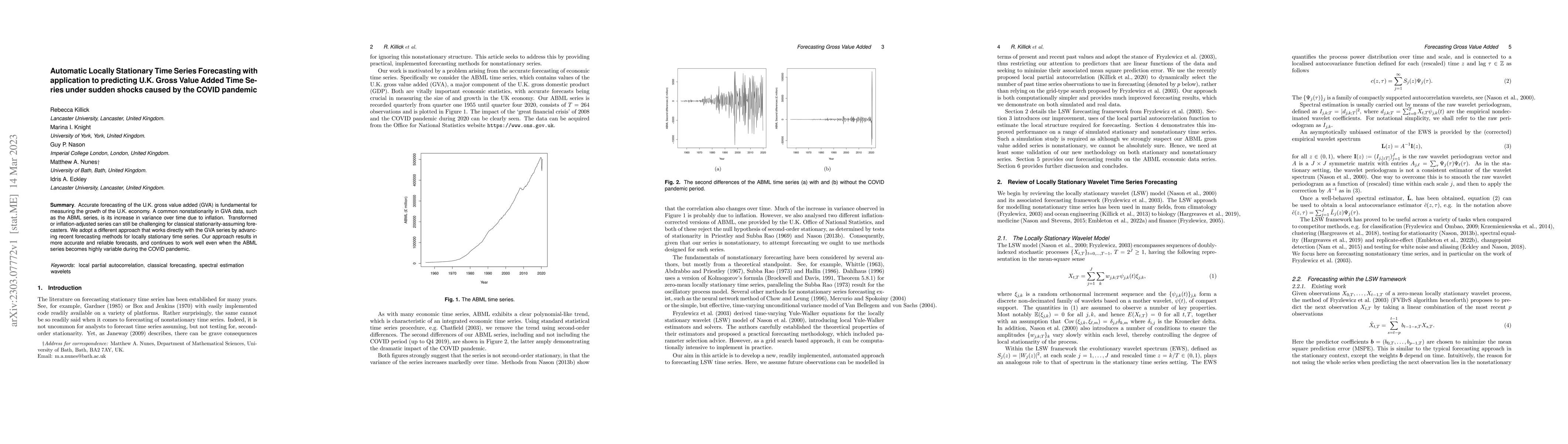

Accurate forecasting of the U.K. gross value added (GVA) is fundamental for measuring the growth of the U.K. economy. A common nonstationarity in GVA data, such as the ABML series, is its increase in variance over time due to inflation. Transformed or inflation-adjusted series can still be challenging for classical stationarity-assuming forecasters. We adopt a different approach that works directly with the GVA series by advancing recent forecasting methods for locally stationary time series. Our approach results in more accurate and reliable forecasts, and continues to work well even when the ABML series becomes highly variable during the COVID pandemic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting of Non-Stationary Sales Time Series Using Deep Learning

Bohdan M. Pavlyshenko

Non-Stationary Time Series Model for Station Based Subway Ridership During Covid-19 Pandemic (Case Study: New York City)

Abolfazl Safikhani, Camille Kamga, Bahman Moghimi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)