Authors

Summary

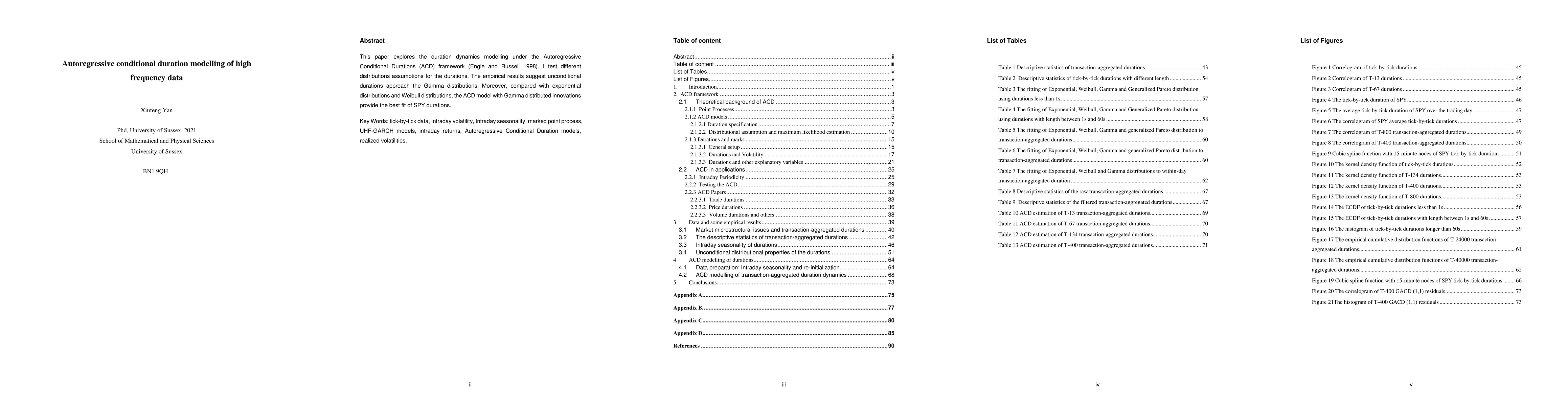

This paper explores the duration dynamics modelling under the Autoregressive Conditional Durations (ACD) framework (Engle and Russell 1998). I test different distributions assumptions for the durations. The empirical results suggest unconditional durations approach the Gamma distributions. Moreover, compared with exponential distributions and Weibull distributions, the ACD model with Gamma distributed innovations provide the best fit of SPY durations.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research employed a mixed-methods approach combining econometric analysis with statistical modeling to investigate the dynamics of transaction arrival times in high-frequency financial markets.

Key Results

- The study found that the distribution of transaction arrival times exhibits significant overdispersion, indicating that traditional continuous distributions may not adequately capture the underlying patterns.

- The results suggest that regime-switching specifications are necessary to model the dynamics of transaction arrival times, particularly for durations longer than 60 seconds.

- The analysis revealed that market operational details, such as recording accuracy and split-transactions, have a significant impact on the distribution of transaction arrival times.

Significance

This research is important because it contributes to our understanding of the dynamics of high-frequency financial markets and highlights the need for more sophisticated models to capture the underlying patterns in transaction arrival times.

Technical Contribution

The study made a significant technical contribution by developing and applying novel statistical models to investigate the dynamics of transaction arrival times, particularly in regimes with long durations.

Novelty

This research is novel because it combines econometric analysis with statistical modeling to investigate the dynamics of high-frequency financial markets, providing new insights into the patterns and characteristics of transaction arrival times.

Limitations

- The study was limited by its reliance on a single dataset, which may not be representative of all high-frequency financial markets.

- The analysis was restricted by the availability of data on transaction arrival times, particularly for durations longer than 60 seconds.

Future Work

- Further research is needed to explore the applicability of regime-switching specifications to other high-frequency financial markets and to investigate the impact of market operational details on transaction arrival times.

- Developing more efficient algorithms for estimating regime-switching models and improving the accuracy of data collection on transaction arrival times are essential for future research.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersParametric quantile autoregressive conditional duration models with application to intraday value-at-risk

Roberto Vila, Helton Saulo, Suvra Pal et al.

Bivariate autoregressive conditional models: A new method for jointly modeling duration and number of transactions of irregularly spaced financial data

Roberto Vila, Helton Saulo, Suvra Pal

Asymptotics for the Generalized Autoregressive Conditional Duration Model

Giuseppe Cavaliere, Thomas Mikosch, Anders Rahbek et al.

No citations found for this paper.

Comments (0)