Authors

Summary

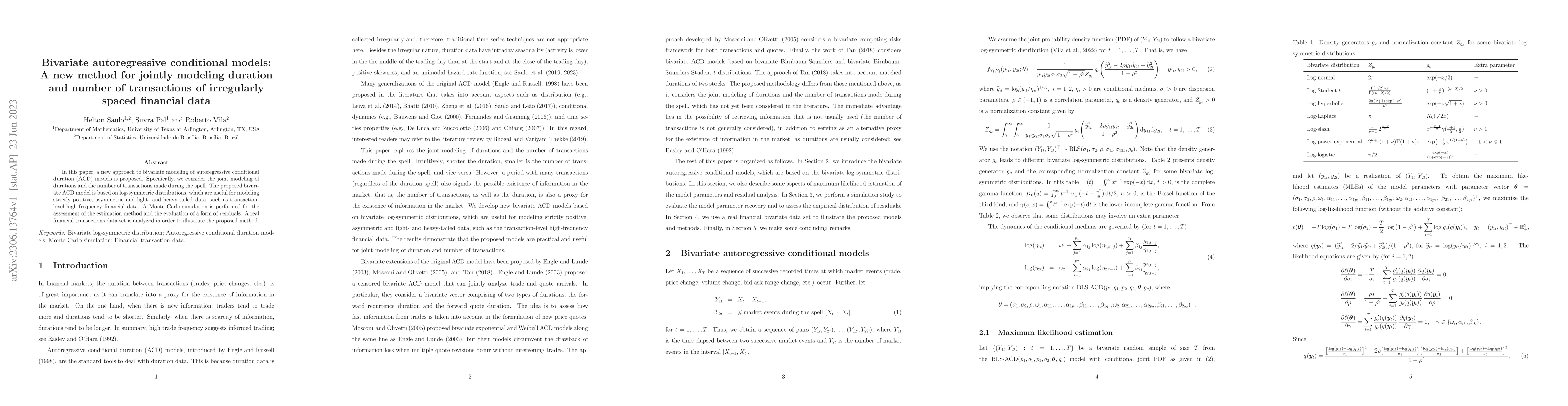

In this paper, a new approach to bivariate modeling of autoregressive conditional duration (ACD) models is proposed. Specifically, we consider the joint modeling of durations and the number of transactions made during the spell. The proposed bivariate ACD model is based on log-symmetric distributions, which are useful for modeling strictly positive, asymmetric and light- and heavy-tailed data, such as transaction-level high-frequency financial data. A Monte Carlo simulation is performed for the assessment of the estimation method and the evaluation of a form of residuals. A real financial transactions data set is analyzed in order to illustrate the proposed method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling Multiple Irregularly Spaced Financial Time Series

Sumanta Basu, Chiranjit Dutta, Nalini Ravishanker

Parametric quantile autoregressive conditional duration models with application to intraday value-at-risk

Roberto Vila, Helton Saulo, Suvra Pal et al.

No citations found for this paper.

Comments (0)