Summary

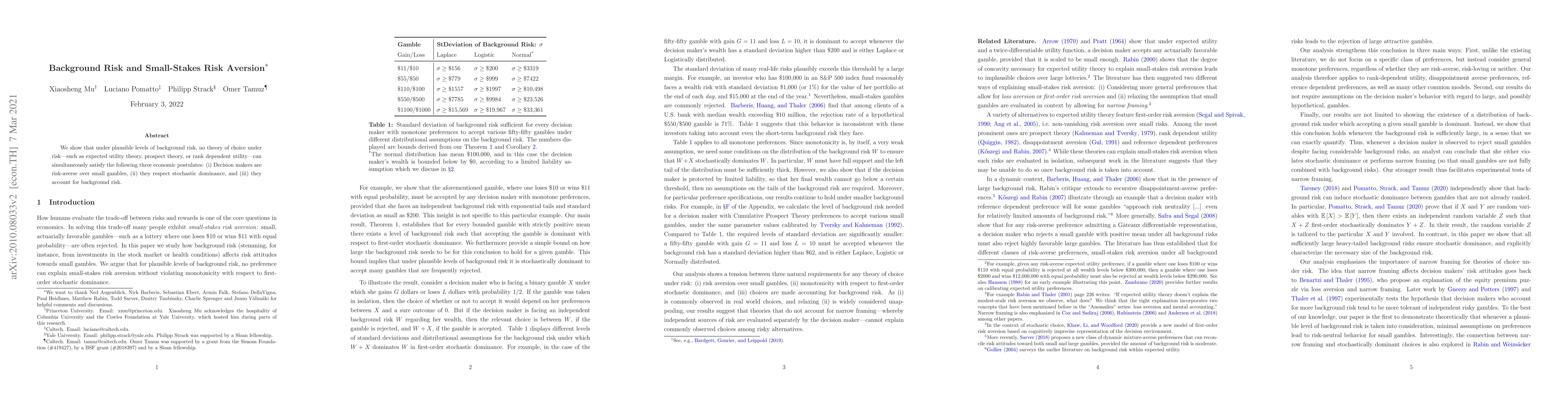

We show that under plausible levels of background risk, no theory of choice under risk -- such as expected utility theory, prospect theory, or rank dependent utility -- can simultaneously satisfy the following three economic postulates: (i) Decision makers are risk-averse over small gambles, (ii) they respect stochastic dominance, and (iii) they account for background risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk Aversion and Insurance Propensity

Ruodu Wang, Qinyu Wu, Fabio Maccheroni et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)