Authors

Summary

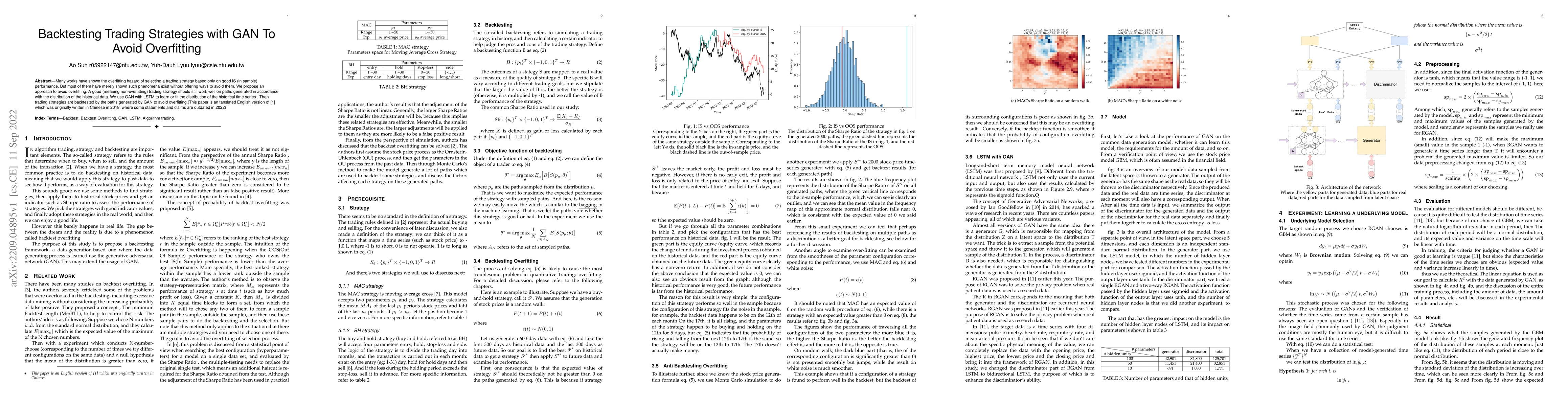

Many works have shown the overfitting hazard of selecting a trading strategy based only on good IS (in sample) performance. But most of them have merely shown such phenomena exist without offering ways to avoid them. We propose an approach to avoid overfitting: A good (meaning non-overfitting) trading strategy should still work well on paths generated in accordance with the distribution of the historical data. We use GAN with LSTM to learn or fit the distribution of the historical time series . Then trading strategies are backtested by the paths generated by GAN to avoid overfitting.(This paper is an tanslated English version of a thesis (10.6342/NTU201801645) which was originally written in Chinese in 2018, where some statements and claims are outdated in 2022)

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)