Authors

Summary

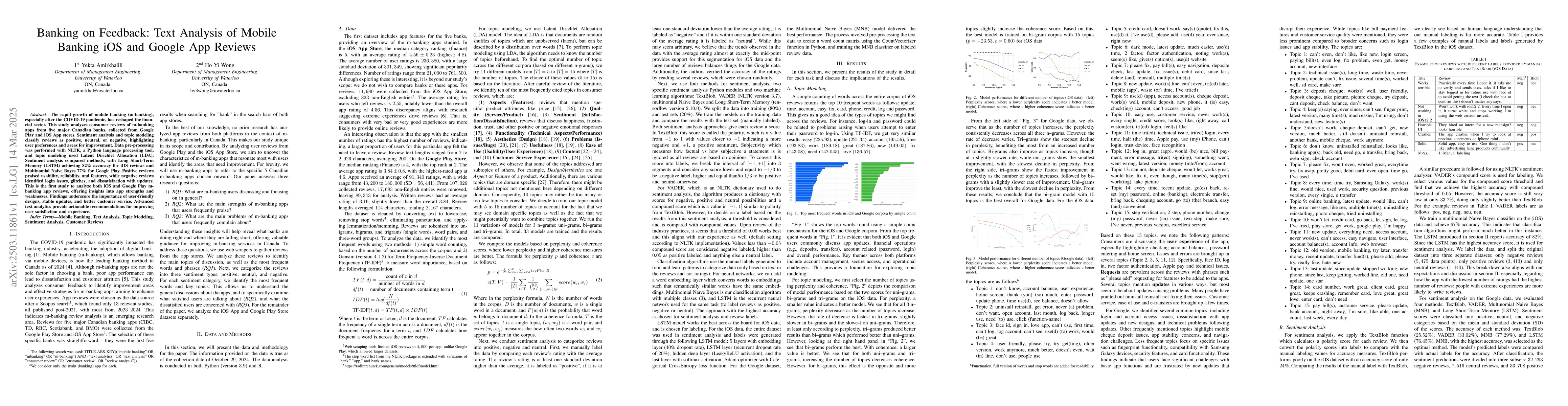

The rapid growth of mobile banking (m-banking), especially after the COVID-19 pandemic, has reshaped the financial sector. This study analyzes consumer reviews of m-banking apps from five major Canadian banks, collected from Google Play and iOS App stores. Sentiment analysis and topic modeling classify reviews as positive, neutral, or negative, highlighting user preferences and areas for improvement. Data pre-processing was performed with NLTK, a Python language processing tool, and topic modeling used Latent Dirichlet Allocation (LDA). Sentiment analysis compared methods, with Long Short-Term Memory (LSTM) achieving 82\% accuracy for iOS reviews and Multinomial Naive Bayes 77\% for Google Play. Positive reviews praised usability, reliability, and features, while negative reviews identified login issues, glitches, and dissatisfaction with updates.This is the first study to analyze both iOS and Google Play m-banking app reviews, offering insights into app strengths and weaknesses. Findings underscore the importance of user-friendly designs, stable updates, and better customer service. Advanced text analytics provide actionable recommendations for improving user satisfaction and experience.

AI Key Findings

Generated Jun 10, 2025

Methodology

This study analyzes consumer reviews of mobile banking apps from five major Canadian banks, collected from Google Play and iOS App stores. Sentiment analysis and topic modeling classify reviews as positive, neutral, or negative, using NLTK for data pre-processing and Latent Dirichlet Allocation (LDA) for topic modeling. Various sentiment analysis methods, including LSTM and Multinomial Naive Bayes, are compared.

Key Results

- LSTM achieved 82% accuracy for iOS reviews, outperforming Multinomial Naive Bayes (77% for Google Play).

- Positive reviews praised usability, reliability, and features, while negative reviews identified login issues, glitches, and dissatisfaction with updates.

- Bi-gram model was the best for capturing coherent topics across both datasets, indicating that phrases provide richer context than single words or trigrams.

- A Naive Bayes classifier, trained on labeled data, achieved 67% accuracy, demonstrating the potential for machine learning models to enhance sentiment classification.

- Negative dataset results reinforced recurring topics like login difficulties, crashes, dissatisfaction with updates, and customer service delays.

Significance

This research offers insights into user experiences and concerns with mobile banking apps, providing actionable recommendations for improving user satisfaction and experience.

Technical Contribution

The study presents a comprehensive analysis of mobile banking app reviews using topic modeling and sentiment analysis, providing a detailed comparison of various methods and their accuracies.

Novelty

This research is the first to analyze both iOS and Google Play mobile banking app reviews, offering unique insights into app strengths and weaknesses across different platforms.

Limitations

- Manually labeling reviews for sentiment analysis was time-consuming and subjective.

- The study focused on Canadian banks, limiting the generalizability of findings to other regions or banking systems.

Future Work

- Explore more sophisticated modeling techniques and include other languages in reviews.

- Consider emoji and sarcasm detection, and extend the analysis to other apps and categories for comparison.

- Compare differences between iOS and Android platforms and investigate automated bot (fake review) detection.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSecurity Analysis of Mobile Banking Application in Qatar

Shaymaa Abdulla Al-Delayel

Measuring User Perceived Security of Mobile Banking Applications

Harjinder Singh Lallie, Richard Apaua

No citations found for this paper.

Comments (0)