Authors

Summary

This paper discusses the security posture of Android m-banking applications in Qatar. Since technology has developed over the years and more security methods are provided, banking is now heavily reliant on mobile applications for prompt service delivery to clients, thus enabling a seamless and remote transaction. However, such mobile banking applications have access to sensitive data for each bank customer which presents a potential attack vector for clients, and the banks. The banks, therefore, have the responsibility to protect the information of the client by providing a high-security layer to their mobile application. This research discusses m-banking applications for Android OS, its security, vulnerability, threats, and solutions. Two m-banking applications were analyzed and benchmarked against standardized best practices, using the combination of two mobile testing frameworks. The security weaknesses observed during the experimental evaluation suggest the need for a more robust security evaluation of a mobile banking application in the state of Qatar. Such an approach would further ensure the confidence of the end-users. Consequently, understanding the security posture would provide a veritable measure towards mbanking security and user awareness.

AI Key Findings

Generated Sep 07, 2025

Methodology

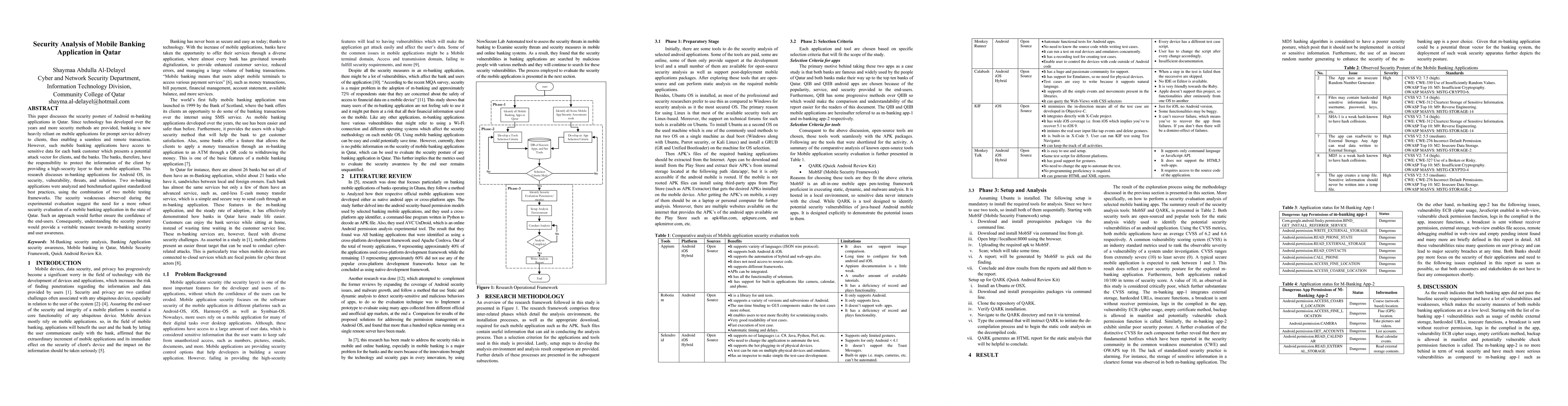

The research methodology involved three phases: preparatory stage, selection criteria, and setup and analysis. The preparatory stage included installing Ubuntu OS and tools like MobSF and QARK for security analysis. The selection criteria focused on popular open-source tools for mobile application security evaluation. The setup and analysis phase involved using MobSF and QARK to perform static analysis on two Android-based mobile banking apps in Qatar.

Key Results

- Both m-banking apps (m-banking app-1 and m-banking app-2) did not meet baseline security requirements.

- Both apps had an average CVSS score of 6.2 and 6.6, respectively, indicating a poor security posture.

- Each app had multiple vulnerabilities, including insecure random number generation, cleartext storage of sensitive information, and weak hashing algorithms.

- M-banking app-2 had more serious vulnerabilities compared to m-banking app-1, such as JavaScript enabled in web-view, vulnerable check permission function, and remote debugging enabled in web-view.

Significance

This research is important as it highlights significant security vulnerabilities in popular mobile banking applications in Qatar, which could impact user privacy and bank reputation. The findings provide a baseline for further exploration of security weaknesses in Android and iOS banking applications in Qatar, ultimately enhancing user trust in mobile banking services.

Technical Contribution

This research contributes by identifying and detailing multiple security vulnerabilities in popular Android-based mobile banking applications in Qatar, providing a comprehensive analysis using open-source security tools like MobSF and QARK.

Novelty

This work stands out by focusing on mobile banking applications in Qatar, which lacks public security evaluation information, and by offering a detailed analysis of vulnerabilities using a combination of mobile testing frameworks.

Limitations

- The study couldn't perform dynamic analysis due to the unavailability of application credentials.

- Access to source code was not granted, limiting low-level security analysis.

- Backend database services couldn't be evaluated for authorization and authentication.

- Limited to a small number of security evaluation tools and mobile banking applications.

Future Work

- Conduct further analysis using additional security tools on more mobile banking applications.

- Collaborate with banking organizations for comprehensive security analysis and prevent false positives.

- Develop a pre- and post-incident analysis framework for mobile banking applications.

- Create a model for evaluating the security posture of mobile applications specific to the context of Qatar.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeasuring User Perceived Security of Mobile Banking Applications

Harjinder Singh Lallie, Richard Apaua

Security Assessment of Mobile Banking Apps in West African Economic and Monetary Union

Steven Arzt, Alioune Diallo, Jordan Samhi et al.

Banking on Feedback: Text Analysis of Mobile Banking iOS and Google App Reviews

Yekta Amirkhalili, Ho Yi Wong

| Title | Authors | Year | Actions |

|---|

Comments (0)