Summary

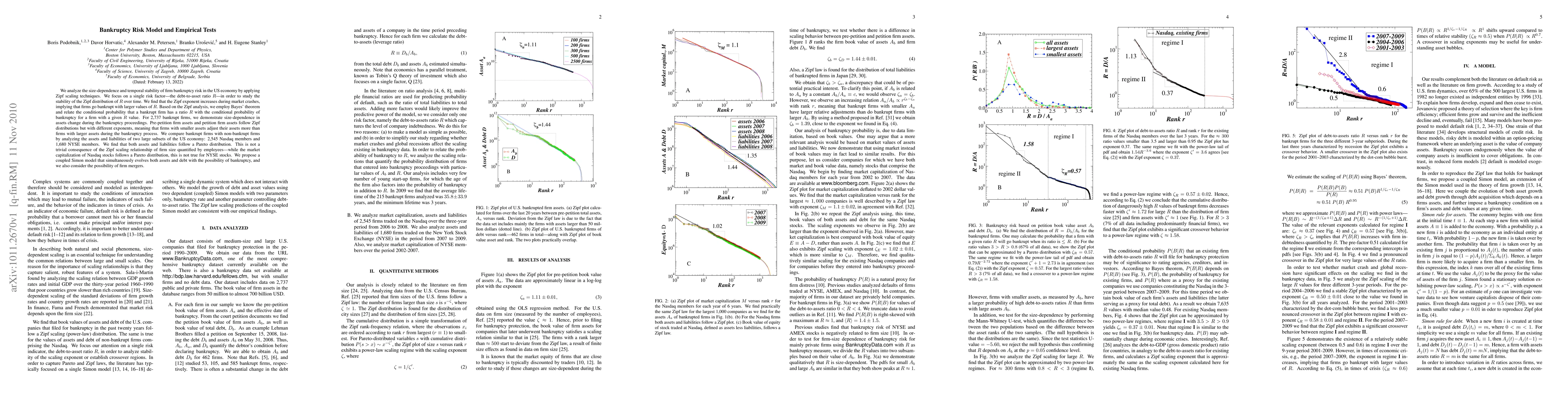

We analyze the size dependence and temporal stability of firm bankruptcy risk in the US economy by applying Zipf scaling techniques. We focus on a single risk factor-the debt-to-asset ratio R-in order to study the stability of the Zipf distribution of R over time. We find that the Zipf exponent increases during market crashes, implying that firms go bankrupt with larger values of R. Based on the Zipf analysis, we employ Bayes's theorem and relate the conditional probability that a bankrupt firm has a ratio R with the conditional probability of bankruptcy for a firm with a given R value. For 2,737 bankrupt firms, we demonstrate size dependence in assets change during the bankruptcy proceedings. Prepetition firm assets and petition firm assets follow Zipf distributions but with different exponents, meaning that firms with smaller assets adjust their assets more than firms with larger assets during the bankruptcy process. We compare bankrupt firms with nonbankrupt firms by analyzing the assets and liabilities of two large subsets of the US economy: 2,545 Nasdaq members and 1,680 New York Stock Exchange (NYSE) members. We find that both assets and liabilities follow a Pareto distribution. The finding is not a trivial consequence of the Zipf scaling relationship of firm size quantified by employees-although the market capitalization of Nasdaq stocks follows a Pareto distribution, the same distribution does not describe NYSE stocks. We propose a coupled Simon model that simultaneously evolves both assets and debt with the possibility of bankruptcy, and we also consider the possibility of firm mergers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCombining Intra-Risk and Contagion Risk for Enterprise Bankruptcy Prediction Using Graph Neural Networks

Qing Li, Ji Liu, Yu Zhao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)