Authors

Summary

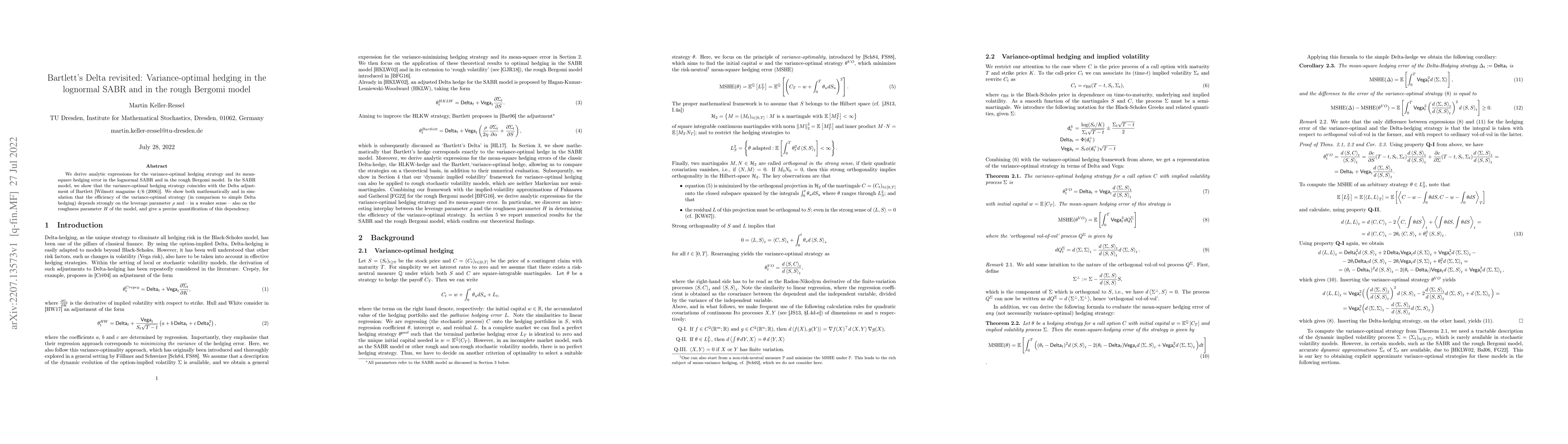

We derive analytic expressions for the variance-optimal hedging strategy and its mean-square hedging error in the lognormal SABR and in the rough Bergomi model. In the SABR model, we show that the variance-optimal hedging strategy coincides with the Delta adjustment of Bartlett [Wilmott magazine 4/6 (2006)]. We show both mathematically and in simulation that the efficiency of the variance-optimal strategy (in comparison to simple Delta hedging) depends strongly on the leverage parameter rho and - in a weaker sense - also on the roughness parameter H of the model, and give a precise quantification of this dependency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)