Summary

The estimation of probabilities of default (PDs) for low default portfolios by means of upper confidence bounds is a well established procedure in many financial institutions. However, there are often discussions within the institutions or between institutions and supervisors about which confidence level to use for the estimation. The Bayesian estimator for the PD based on the uninformed, uniform prior distribution is an obvious alternative that avoids the choice of a confidence level. In this paper, we demonstrate that in the case of independent default events the upper confidence bounds can be represented as quantiles of a Bayesian posterior distribution based on a prior that is slightly more conservative than the uninformed prior. We then describe how to implement the uninformed and conservative Bayesian estimators in the dependent one- and multi-period default data cases and compare their estimates to the upper confidence bound estimates. The comparison leads us to suggest a constrained version of the uninformed (neutral) Bayesian estimator as an alternative to the upper confidence bound estimators.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

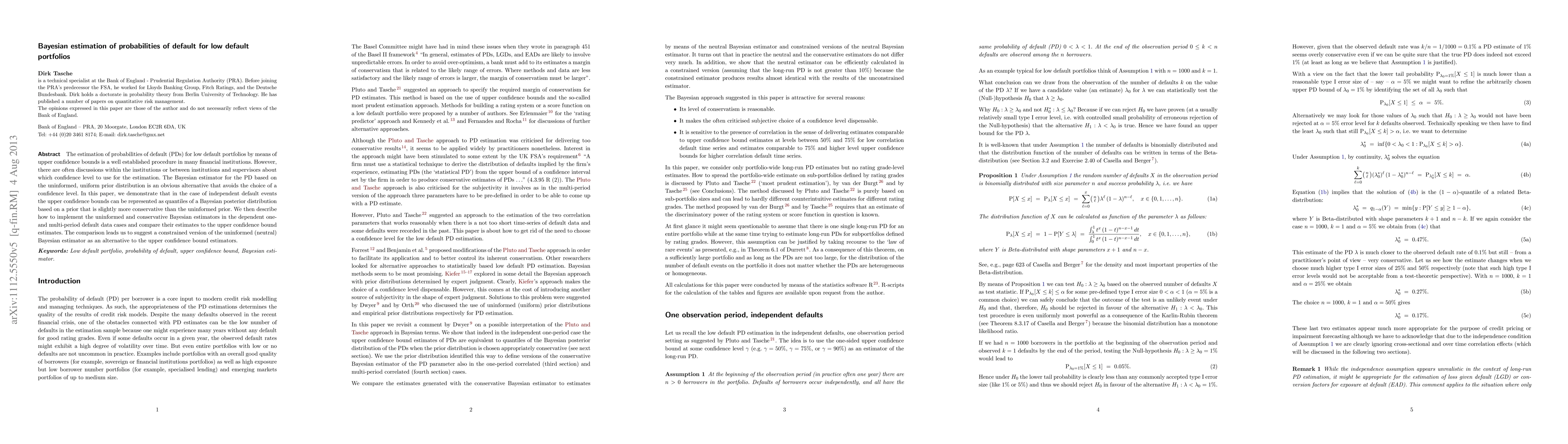

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)