Summary

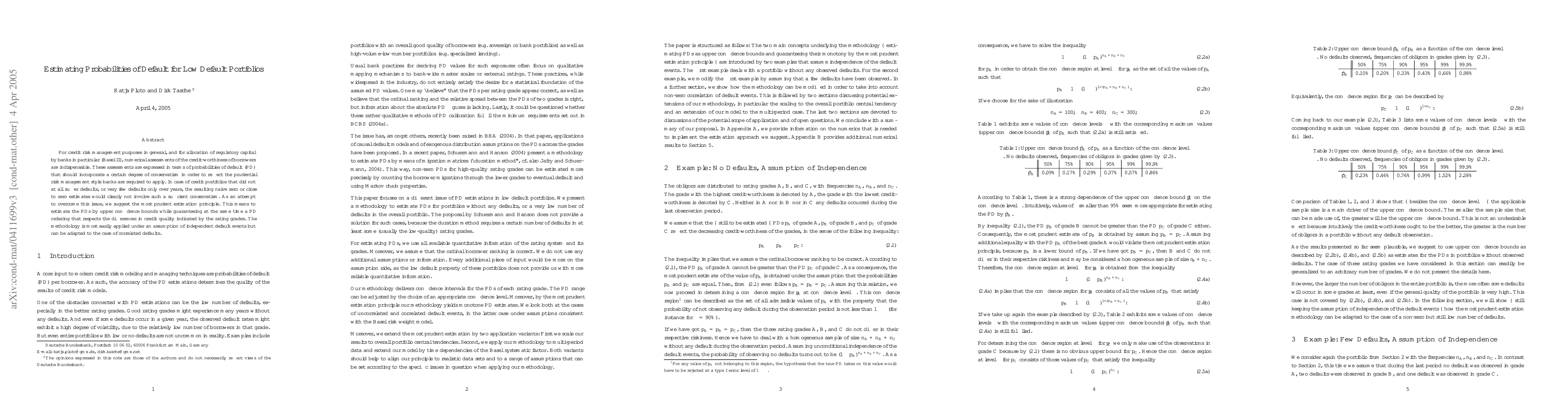

For credit risk management purposes in general, and for allocation of regulatory capital by banks in particular (Basel II), numerical assessments of the credit-worthiness of borrowers are indispensable. These assessments are expressed in terms of probabilities of default (PD) that should incorporate a certain degree of conservatism in order to reflect the prudential risk management style banks are required to apply. In case of credit portfolios that did not at all suffer defaults, or very few defaults only over years, the resulting naive zero or close to zero estimates would clearly not involve such a sufficient conservatism. As an attempt to overcome this issue, we suggest the "most prudent estimation" principle. This means to estimate the PDs by upper confidence bounds while guaranteeing at the same time a PD ordering that respects the differences in credit quality indicated by the rating grades. The methodology is most easily applied under an assumption of independent default events but can be adapted to the case of correlated defaults.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)