Summary

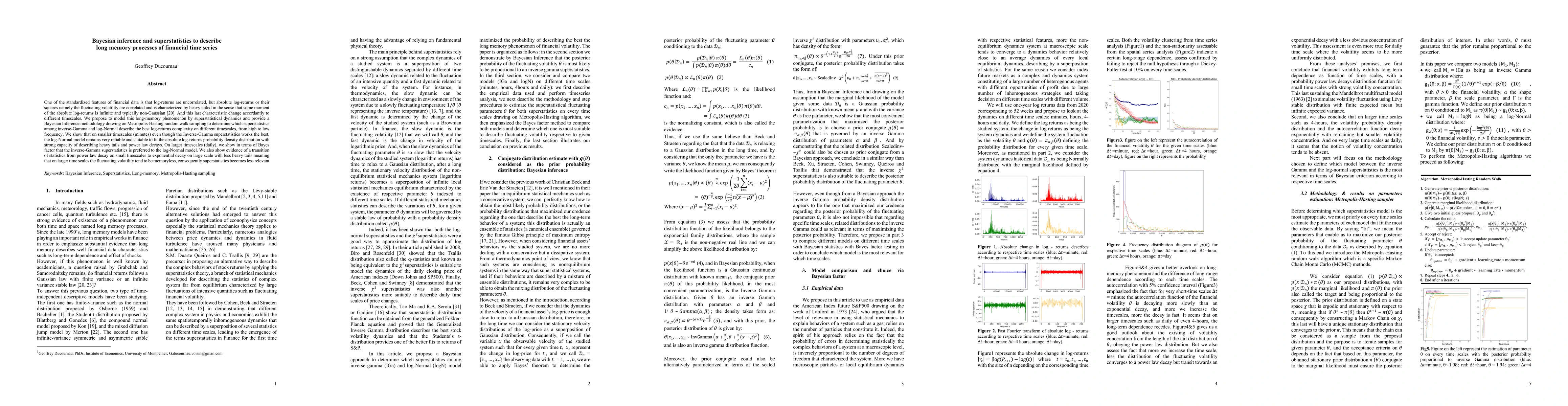

One of the standardized features of financial data is that log-returns are uncorrelated, but absolute log-returns or their squares namely the fluctuating volatility are correlated and is characterized by heavy tailed in the sense that some moment of the absolute log-returns is infinite and typically non-Gaussian [20]. And this last characteristic change accordantly to different timescales. We propose to model this long-memory phenomenon by superstatistical dynamics and provide a Bayesian Inference methodology drawing on Metropolis-Hasting random walk sampling to determine which superstatistics among inverse-Gamma and log-Normal describe the best log-returns complexity on different timescales, from high to low frequency. We show that on smaller timescales (minutes) even though the Inverse-Gamma superstatistics works the best, the log-Normal model remains very reliable and suitable to fit the absolute log-returns probability density distribution with strong capacity of describing heavy tails and power law decays. On larger timescales (daily), we show in terms of Bayes factor that the inverse-Gamma superstatistics is preferred to the log-Normal model. We also show evidence of a transition of statistics from power law decay on small timescales to exponential decay on large scale with less heavy tails meaning that on larger time scales the fluctuating volatility tend to be memoryless, consequently superstatistics becomes less relevant.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)