Summary

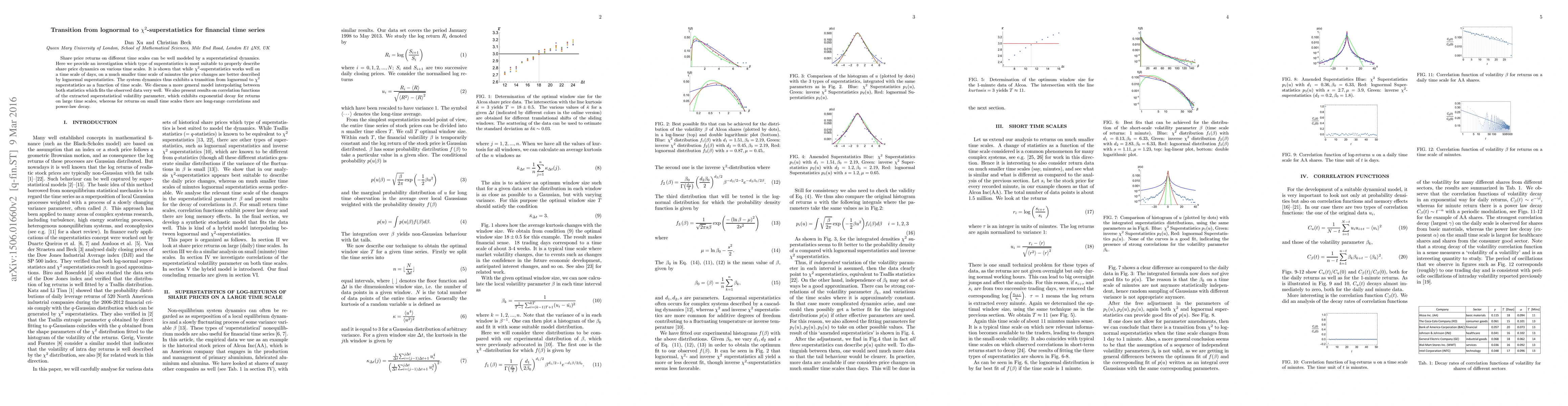

Share price returns on different time scales can be well modelled by a superstatistical dynamics. Here we provide an investigation which type of superstatistics is most suitable to properly describe share price dynamics on various time scales. It is shown that while chi-square superstatistics works well on a time scale of days, on a much smaller time scale of minutes the price changes are better described by lognormal superstatistics. The system dynamics thus exhibits a transition from lognormal to chi-square superstatistics as a function of time scale. We discuss a more general model interpolating between both statistics which fits the observed data very well. We also present results on correlation functions of the extracted superstatistical volatility parameter, which exhibits exponential decay for returns on large time scales, whereas for returns on small time scales there are long-range correlations and power-law decay.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)