Summary

For modeling multivariate financial time series we propose a single factor copula model together with stochastic volatility margins. This model generalizes single factor models relying on the multivariate normal distribution and allows for symmetric and asymmetric tail dependence. We develop joint Bayesian inference using Hamiltonian Monte Carlo (HMC) within Gibbs sampling. Thus we avoid information loss caused by the two-step approach for margins and dependence in copula models as followed by Schamberger et al(2017). Further, the Bayesian approach allows for high dimensional parameter spaces as they are present here in addition to uncertainty quantification through credible intervals. By allowing for indicators for different copula families the copula families are selected automatically in the Bayesian framework. In a first simulation study the performance of HMC is compared to the Markov Chain Monte Carlo (MCMC) approach developed by Schamberger et al(2017) for the copula part. It is shown that HMC considerably outperforms this approach in terms of effective sample size, MSE and observed coverage probabilities. In a second simulation study satisfactory performance is seen for the full HMC within Gibbs procedure. The approach is illustrated for a portfolio of financial assets with respect to one-day ahead value at risk forecasts. We provide comparison to a two-step estimation procedure of the proposed model and to relevant benchmark models: a model with dynamic linear models for the margins and a single factor copula for the dependence proposed by Schamberger et al(2017) and a multivariate factor stochastic volatility model proposed by Kastner et al(2017). Our proposed approach shows superior performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

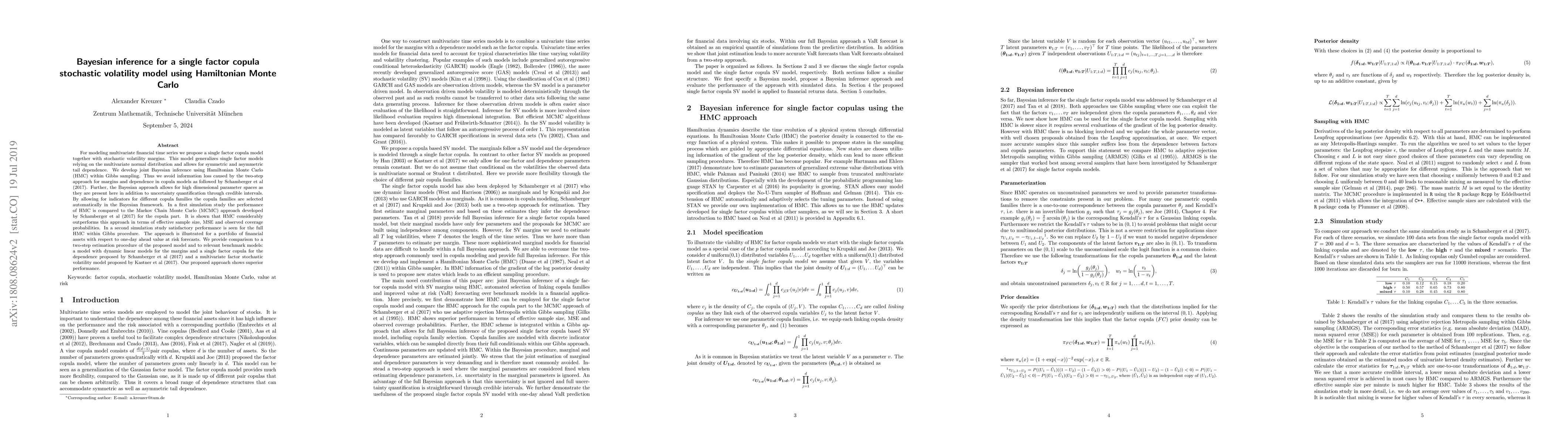

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)