Summary

One of the most popular copulas for modeling dependence structures is t-copula. Recently the grouped t-copula was generalized to allow each group to have one member only, so that a priori grouping is not required and the dependence modeling is more flexible. This paper describes a Markov chain Monte Carlo (MCMC) method under the Bayesian inference framework for estimating and choosing t-copula models. Using historical data of foreign exchange (FX) rates as a case study, we found that Bayesian model choice criteria overwhelmingly favor the generalized t-copula. In addition, all the criteria also agree on the second most likely model and these inferences are all consistent with classical likelihood ratio tests. Finally, we demonstrate the impact of model choice on the conditional Value-at-Risk for portfolios of six major FX rates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

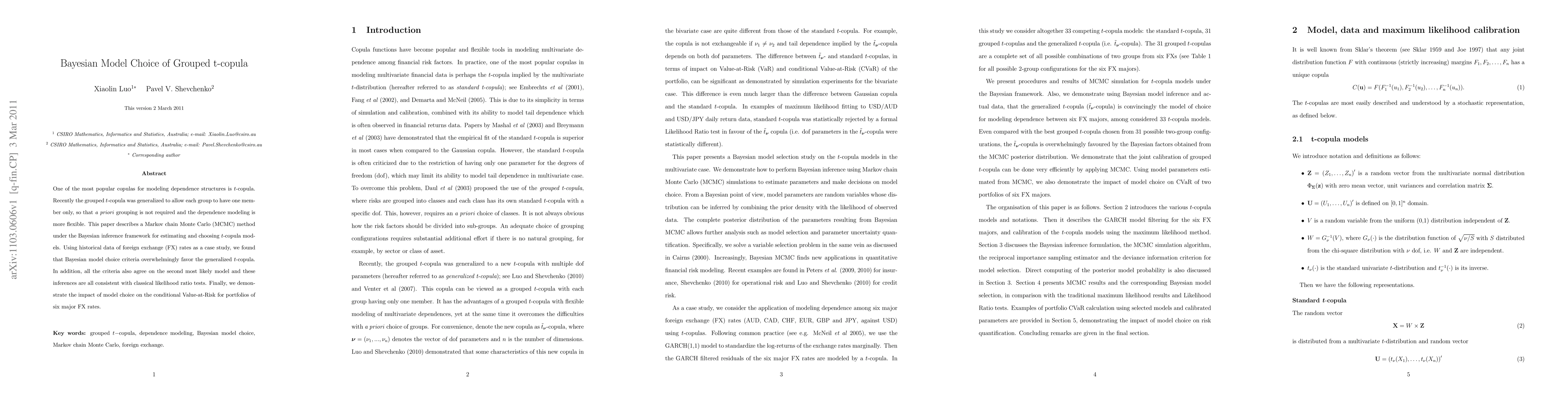

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTractable Unified Skew-t Distribution and Copula for Heterogeneous Asymmetries

Michael Stanley Smith, Lin Deng, Worapree Maneesoonthorn

| Title | Authors | Year | Actions |

|---|

Comments (0)