Summary

We discuss a Bayesian hierarchical copula model for clusters of financial time series. A similar approach has been developed in Zhuang et al. (2020). However, the prior distributions proposed there do not always provide a proper posterior. In order to circumvent the problem, we adopt a proper global-local shrinkage prior, which is also able to account for potential dependence structure among different clusters. The performance of the proposed model is presented through simulations and a real data analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

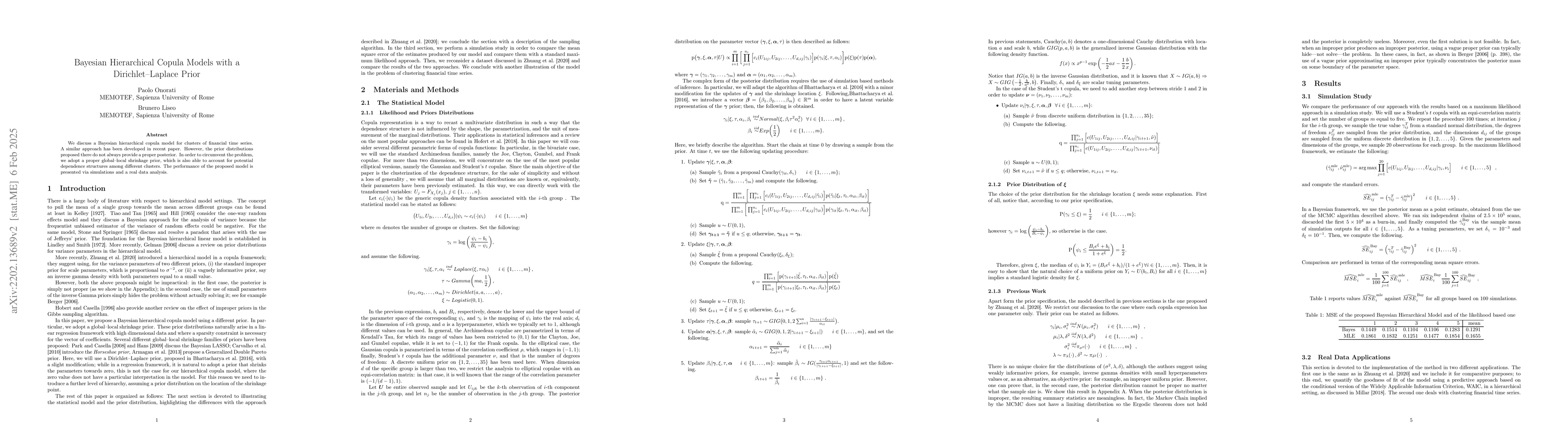

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA dynamic copula model for probabilistic forecasting of non-Gaussian multivariate time series

Daniel R. Kowal, John Zito

No citations found for this paper.

Comments (0)