Summary

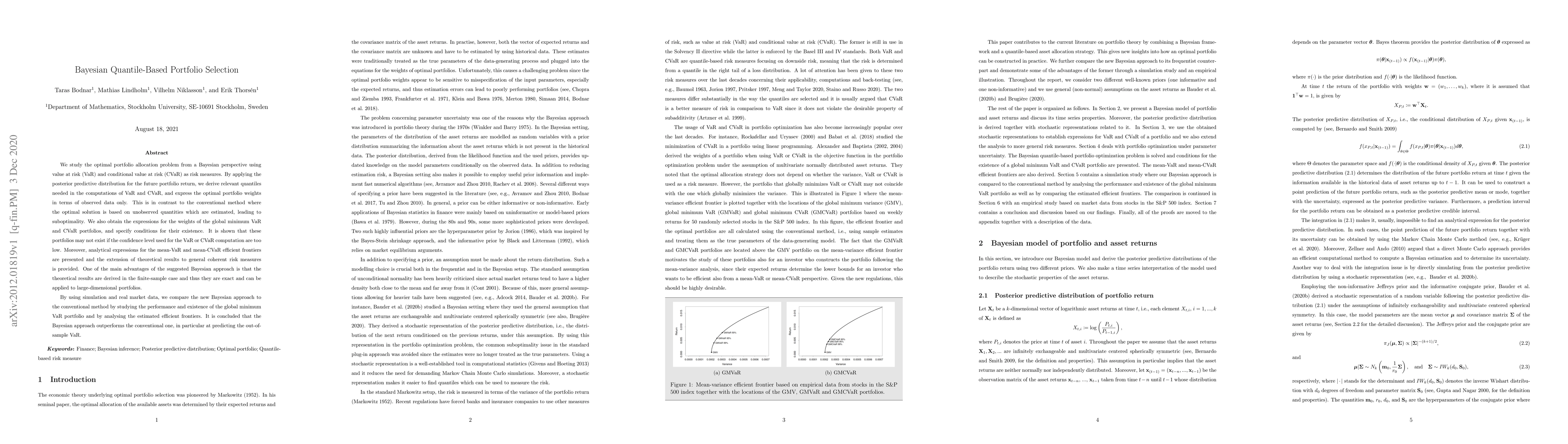

We study the optimal portfolio allocation problem from a Bayesian perspective using value at risk (VaR) and conditional value at risk (CVaR) as risk measures. By applying the posterior predictive distribution for the future portfolio return, we derive relevant quantiles needed in the computations of VaR and CVaR, and express the optimal portfolio weights in terms of observed data only. This is in contrast to the conventional method where the optimal solution is based on unobserved quantities which are estimated, leading to suboptimality. We also obtain the expressions for the weights of the global minimum VaR and CVaR portfolios, and specify conditions for their existence. It is shown that these portfolios may not exist if the confidence level used for the VaR or CVaR computation are too low. Moreover, analytical expressions for the mean-VaR and mean-CVaR efficient frontiers are presented and the extension of theoretical results to general coherent risk measures is provided. One of the main advantages of the suggested Bayesian approach is that the theoretical results are derived in the finite-sample case and thus they are exact and can be applied to large-dimensional portfolios. By using simulation and real market data, we compare the new Bayesian approach to the conventional method by studying the performance and existence of the global minimum VaR portfolio and by analysing the estimated efficient frontiers. It is concluded that the Bayesian approach outperforms the conventional one, in particular at predicting the out-of-sample VaR.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Quantile Regression with Subset Selection: A Posterior Summarization Perspective

Joseph Feldman, Daniel Kowal

Sparse Portfolio selection via Bayesian Multiple testing

Sourish Das, Rituparna Sen

| Title | Authors | Year | Actions |

|---|

Comments (0)