Authors

Summary

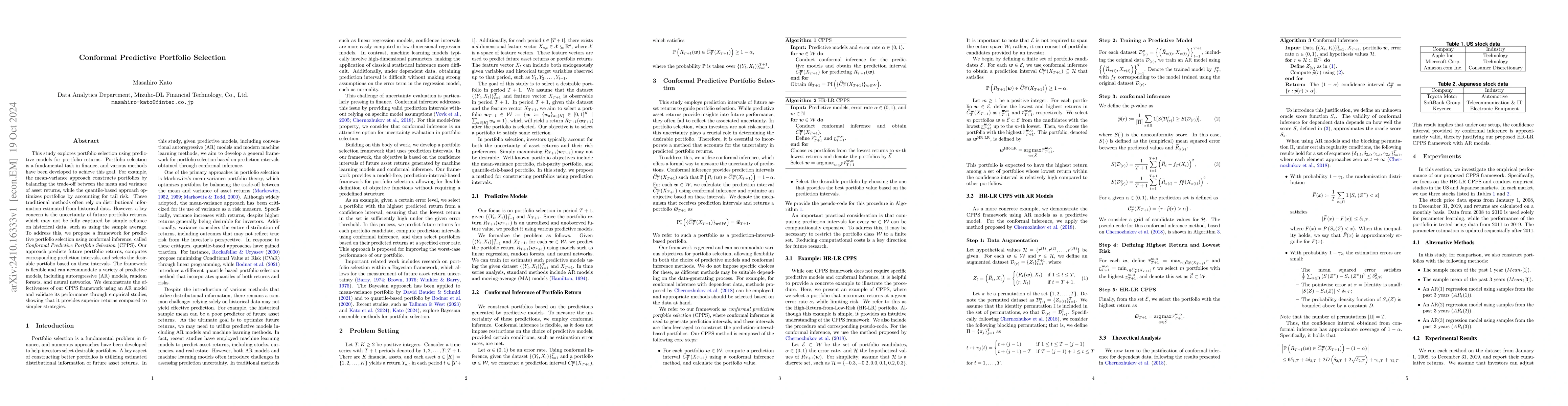

This study explores portfolio selection using predictive models for portfolio returns. Portfolio selection is a fundamental task in finance, and various methods have been developed to achieve this goal. For example, the mean-variance approach constructs portfolios by balancing the trade-off between the mean and variance of asset returns, while the quantile-based approach optimizes portfolios by accounting for tail risk. These traditional methods often rely on distributional information estimated from historical data. However, a key concern is the uncertainty of future portfolio returns, which may not be fully captured by simple reliance on historical data, such as using the sample average. To address this, we propose a framework for predictive portfolio selection using conformal inference, called Conformal Predictive Portfolio Selection (CPPS). Our approach predicts future portfolio returns, computes corresponding prediction intervals, and selects the desirable portfolio based on these intervals. The framework is flexible and can accommodate a variety of predictive models, including autoregressive (AR) models, random forests, and neural networks. We demonstrate the effectiveness of our CPPS framework using an AR model and validate its performance through empirical studies, showing that it provides superior returns compared to simpler strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChatGPT-based Investment Portfolio Selection

Oleksandr Romanko, Akhilesh Narayan, Roy H. Kwon

Bayesian Portfolio Optimization by Predictive Synthesis

Masahiro Kato, Ryo Inokuchi, Kentaro Baba et al.

No citations found for this paper.

Comments (0)