Summary

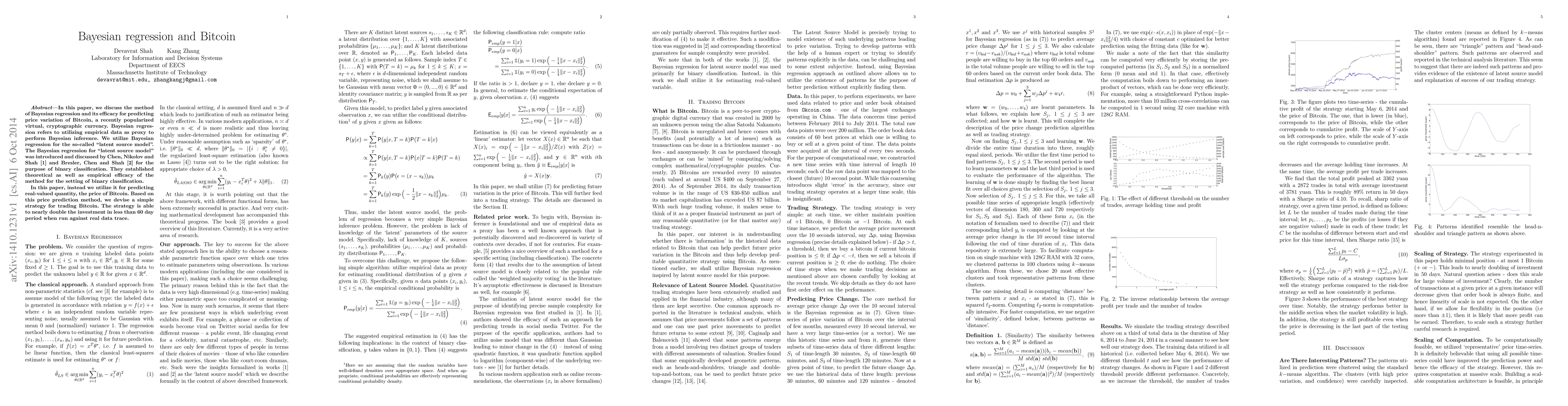

In this paper, we discuss the method of Bayesian regression and its efficacy for predicting price variation of Bitcoin, a recently popularized virtual, cryptographic currency. Bayesian regression refers to utilizing empirical data as proxy to perform Bayesian inference. We utilize Bayesian regression for the so-called "latent source model". The Bayesian regression for "latent source model" was introduced and discussed by Chen, Nikolov and Shah (2013) and Bresler, Chen and Shah (2014) for the purpose of binary classification. They established theoretical as well as empirical efficacy of the method for the setting of binary classification. In this paper, instead we utilize it for predicting real-valued quantity, the price of Bitcoin. Based on this price prediction method, we devise a simple strategy for trading Bitcoin. The strategy is able to nearly double the investment in less than 60 day period when run against real data trace.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBitcoin Price Predictive Modeling Using Expert Correction

Bohdan M. Pavlyshenko

| Title | Authors | Year | Actions |

|---|

Comments (0)